Several industries have now started showing enthusiasm in drones for delivery, agriculture and the military has been one of the old players in the game. Whereas, Indian Defence forces have been and continue to be the key players in adopting drones on a bigger scale. Therefore, the acceleration in practice and manufacturing of drones, is prophesied to expand and evolve in the coming times. Especially after the relaxation of stringent drone rules in August 2021, the usage of drones will increase by many folds. However, being a still nascent industry, the rules may change over a certain period. Hence, staying abreast with all the regulations is the only way to not land up yourself in unpleasant scenarios of paying fines or ending up behind the bars.

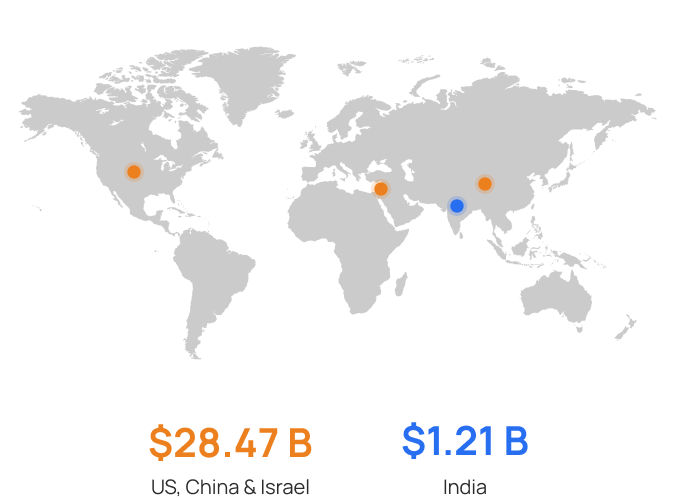

Having said that, The Print reports, “the global drone market, which is currently dominated by the US, China and Israel, will touch $28.47 billion this year and India will comprise about 4.25 per cent of that. Consequently, the Indian drone market is expected to reach $1.21 billion in 2021.” Therefore, the giants in the industries are going to invest in drones and their technologies much more in the near future.

As we see steady growth in the drone industry, we also see several doubts and chaos regarding the rules and regulations. Also, there’s a lot of buzz around investing in drone insurance. If you are looking forward to securing your drone or your fleet and aren’t sure, like a lot around, then we have debunked a few myths that may help you in your decision.

Insuring a drone isn’t as difficult as it seems, however, it is worth the investment. With the new rules that were released, having drone insurance has now become mandatory. Comprehensive drone insurance not only secures the drone but also the drone parts such as cameras. This offers protection for damages caused to third parties as a result of drone accidents and usually includes coverage for physical injury and any property damages. Apart from the government mandate, public protection should top the priority list. Companies require liability insurance before they fly drones in any location. Commercial drone insurance coverage varies depending on your policy and declared limits.

However, when a company buys drones, they buy them in bulk. It yields a substantial cost saving in terms of insurance premiums. Furthermore, despite 20% to 25% of insured drones crashing from the fleet, there is still a cost savings of 70% to 300% based on the fleet size and the age of drones.

While flying, many people generally tend to pay no attention to the fact that drones may crash too. Yes, with the improvement in drone-tech, there are several high-quality drones that are being manufactured. However, drones can crash, and may damage third-party properties too. Drones can crash for several reasons like technical problems, hitting return-to-home soon, power failure and micro-climatic conditions in various regions across India. Therefore, investing in drone insurance can help during such unforeseen circumstances.

Several commercial fliers or recreational fliers, use drones for shorter periods either for a particular delivery or filming. A lot of them aren’t aware that accidents may happen even during those short hours of flying. Hence, they ignore the need for insurance, hoping the drones do not cause damage to any other property. Also, having drone insurance is important even for individual fliers, not only because it is mandatory but as it safeguards others lives and properties.

Well, so are a lot of insurances! There are several insurances that an individual invests over a lifetime to protect themselves or their surroundings from any harm or injury. However, a lot of us are not aware that the Indian government has made it mandatory to have drone insurance. This is mainly due to negligence and also because the implementation rules are not strict yet. Comprehensive drone insurance offers protection for damages caused to third-parties as a result of drone accidents and usually includes coverage for physical injuries and any property damages. Apart from the government mandate, public protection should top the priority list for any company or drone flier.

Companies that require a group of drones to get certain tasks done are not aware of fleet coverage available for them. Drones are costly and any damage to them owing to either the technology or weather conditions, repairs can be costly too. A corporation using drones for commercial purposes can opt for insurance that secures all the drones in the fleet. Bulk insurance policies are generally cheaper than single drone policies. This can save a lot of cost and effort spent by the corporations.

With the rise in the use of drone technology and the steady growth of usage of drones across industries, it is important to keep in mind public safety. It is the responsibility of these industries and commercial drone owners to not harm the surroundings while carrying out drone tasks.

While several giants have already started using drones for several purposes, only in the coming times, we will know if they are cautious about the drone rules and regulations. Till then, having drone insurance is a smart move. Therefore, investing in comprehensive insurance (Third-Party + Accidental Damage) cover for drones will be extremely useful.