Uncrewed Aerial Vehicles (UAV) are used extensively today. The Directorate General of Civil Aviation (DGCA) mandates third-party liability insurance for all drone operators. Whether you are operating a drone for commercial purposes, or personal use, flying without insurance is illegal and can lead to severe consequences. Besides, it is always advisable to have insurance that can cover you against accidents or any unforeseen circumstances.

Note: Only Nano drones (weighing less than 250 grams) have a permit exemption, provided they are flown below 50 feet.

Drone insurance safeguards your life along with others and helps you to have a safe flying experience. Most drone insurance policies provide third party liability coverage. Operators can choose to add hull coverage or physical damage as well.

Currently, drone operators in India have minimum levels of insurance like the Third-Party Liability cover. This cover protects you against liability to others in the event that property is damaged or people are injured while flying your drone. As a policyholder, you can buy additional coverage for personal injury liability, non-owned liability (property damage or bodily injury caused while operating someone else’s drone), premises liability and war perils (damage resulting from a malicious act). A comprehensive drone insurance policy covers the drone related risks and ensures public confidence in the insurance standards as the market develops gradually. It includes drone hull cover, third party liability cover, payload cover. This is available for No Permission No takeoff (NPNT) compliant & Non-NPNT compliant drones.

If you are new to the world of drone insurance, here is your chance to familiarize yourself with some key insurance terms before we delve deep into the topic.

Life is uncertain and accidents cannot be predicted. Drones are gadgets with remote control. Consider these situations - your drone batteries could die mid-air, the drone could have a technical glitch, or the remote control could develop an error. In these circumstances, accidents are inevitable. Your drone could fall in a crowded area or injure people on its way down. It could also land on someone’s private property or vehicle. In these situations, you, as the drone operator, would be held responsible for all the damages. You may also be required to provide compensation. And this is where third-party liability drone insurance can protect you.

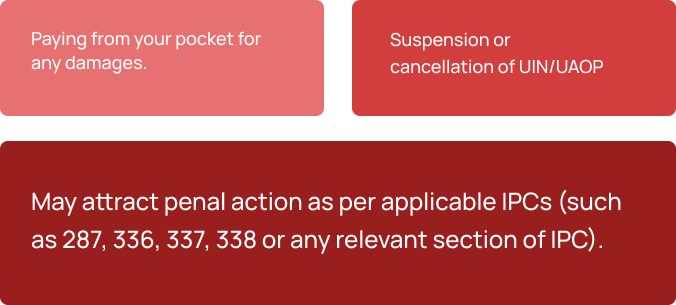

Good third-party liability insurance must cover you in all the above-mentioned situations, and any other third-party damages. The purpose of insurance is to ensure that you do not need to pay out of your pocket. In case of accidents, third-parties have the right to demand compensation, or even sue you. In such scenarios, your insurance policy must be able to cover you for all expenses involved.

Ask your insurance provider the following questions:

Once you are convinced with answers, then go ahead and purchase your insurance cover.

Finding a reliable third-party drone insurance provider can feel like a daunting task. Honestly, you need to find an insurance provider who has long-standing credibility in the market.

It is not humanly possible to fly drones at a stretch. Ideally, your insurance should cover you only for the duration that you wish to fly. If you fly for a few hours, look for micro insurance that will give you all the benefits of long-term insurance. If you are a frequent flyer, a monthly plan may be more economical perhaps. You can also buy annual insurance covers depending upon your usage. Thus, it is subjective and depends on a person’s or an entity’s needs.

The most common types of drone insurance are liability and hull insurance. Then there is payload insurance that covers your expensive thermal or multispectral camera and other parts. You can also insure your ground station, laptop, and tablets.

Once you select your third-party liability insurance provider, ask the following questions to make an informed decision, and make sure that you find the best deal.

Your insurance provider will expect you to maintain certain guidelines and timelines so that your policy remains valid. Similarly, you must also have certain expectations from your potential insurance provider. Do not purchase insurance only because it is mandatory; instead, purchase insurance because your insurance provider is giving you the best deal, and this is for your good.

The Insurance Regulatory and Development Authority of India (IRDAI) has issued a template policy, which has several types of cover that general insurance firms may offer in their product. In a circular sent to insurance companies, IRDAI has mentioned that there is a need to enhance the current insurance availability given the unique characteristics of drones that differentiate them from other aircraft, as well as the remarkable growth in drone usage recently. Here’s what you need to know:

Note: According to the Digital Sky platform, all drones are restricted to daylight and within the visual line of sight. However, if you need to do a nighttime photoshoot, ensure you do it in well-lit enclosed premises using micro drones up to 200 ft only. Also, ensure your drone is No Permission No Takeoff (NPNT) compliant and has a valid Unique Identification Number. Furthermore, you must inform the local police before flying.

The drone insurance policy will not cover the following:

Generally, for third-party liability policies covering bodily injuries, the premium ranges between 0.5 percent and 0.75 percent of the sum insured. However, the cost of your drone insurance depends on many factors including the insurance package you need, your experience, and the specifics of your drone operation.

While submitting a claim, consider the following:

Note: This is indicative and not an exhaustive list. This may vary as per the insurance company's claims procedural policy.

1. Notify the insurance company of any impending prosecution or FIR wherever applicable.

2. Provide intimation of accidents involving the drone to the appropriate authority at DGCA.

3. The drone operator must inform DGCA in the event of drone damage and/or it cannot be returned to its original condition. Following this, the UIN will be cancelled.

4. The operator should not try to repair or dismantle the drone without the permission of the insurer, unless it is needed in the interest of safety.

As the Civil Aviation Requirement 1.0- (Requirements for Operation of Civil Remotely Piloted Aircraft System (RPAS)- Section 17) mandates third party liability drone insurance, companies are focusing on developing unique and innovative solutions.

For example, last year, HDFC Ergo, India’s third-largest private sector general insurer tied up with Tropogo, India’s first drone marketplace, to provide commercial drone owners and operators third-party liability cover for property damages and physical injuries from drones. In an industry-first initiative, customers can get 'pay as you fly' insurance policy on-demand based on the number of hours they fly. Through TropoGo app, users can directly buy mandatory drone insurance as per their needs - 4 Hours, 1 Day, 1 year.

National Insurance has recently rolled Beyond Visual Line of Sight (BVLOS) drone insurance. This insurance is exclusively designed for the group selected by the DGCA to conduct BVLOS test flights. This cover aims to safeguard the risk of any loss or damage to a third-party due to any accident during the test flights.

Amber Dubey, Joint Secretary, Ministry of Civil Aviation, envisions India to be the drone hub in future to embody the true spirit of Atma Nirbhar Bharat. For this to happen soon, drone companies should attain more scalability, which can come through a balanced approach towards demand, supply, regulations, and of course drone insurance for a holistic drone ecosystem.