Drones are becoming more popular and useful in various fields and applications, such as photography, delivery, agriculture, surveillance, and entertainment. However, flying a drone also comes with certain risks and responsibilities, especially in a country like India, where the regulations and rules are constantly evolving and updating. One of the most important aspects of drone operation is having a valid and adequate drone insurance policy that can protect you from any liability or damage that may arise from your drone activities.

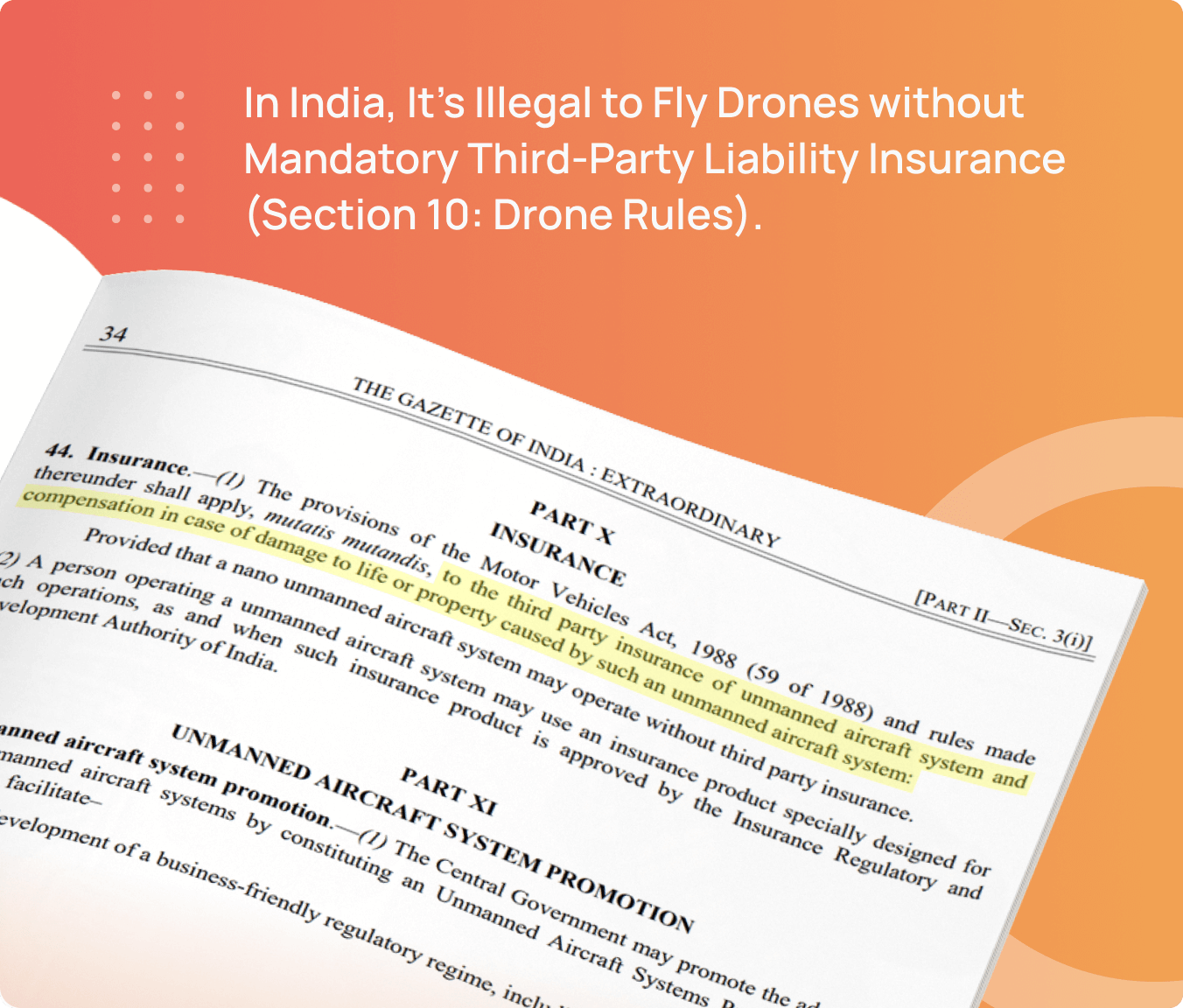

Drone insurance is mandatory for all drone operators in India, except for those who fly nano drones (weighing less than 250 grams) below 50 feet. The minimum requirement is to have a third-party liability insurance cover, which can cover any bodily injury or property damage caused by your drone to others. However, you can also opt for a comprehensive drone insurance policy, which can cover your drone hull, payload, and other additional features.

In India, it is illegal to fly drones without Third-Party Liability Insurance (Section 10: Drone Rules 2021, Ministry of Civil Aviation).

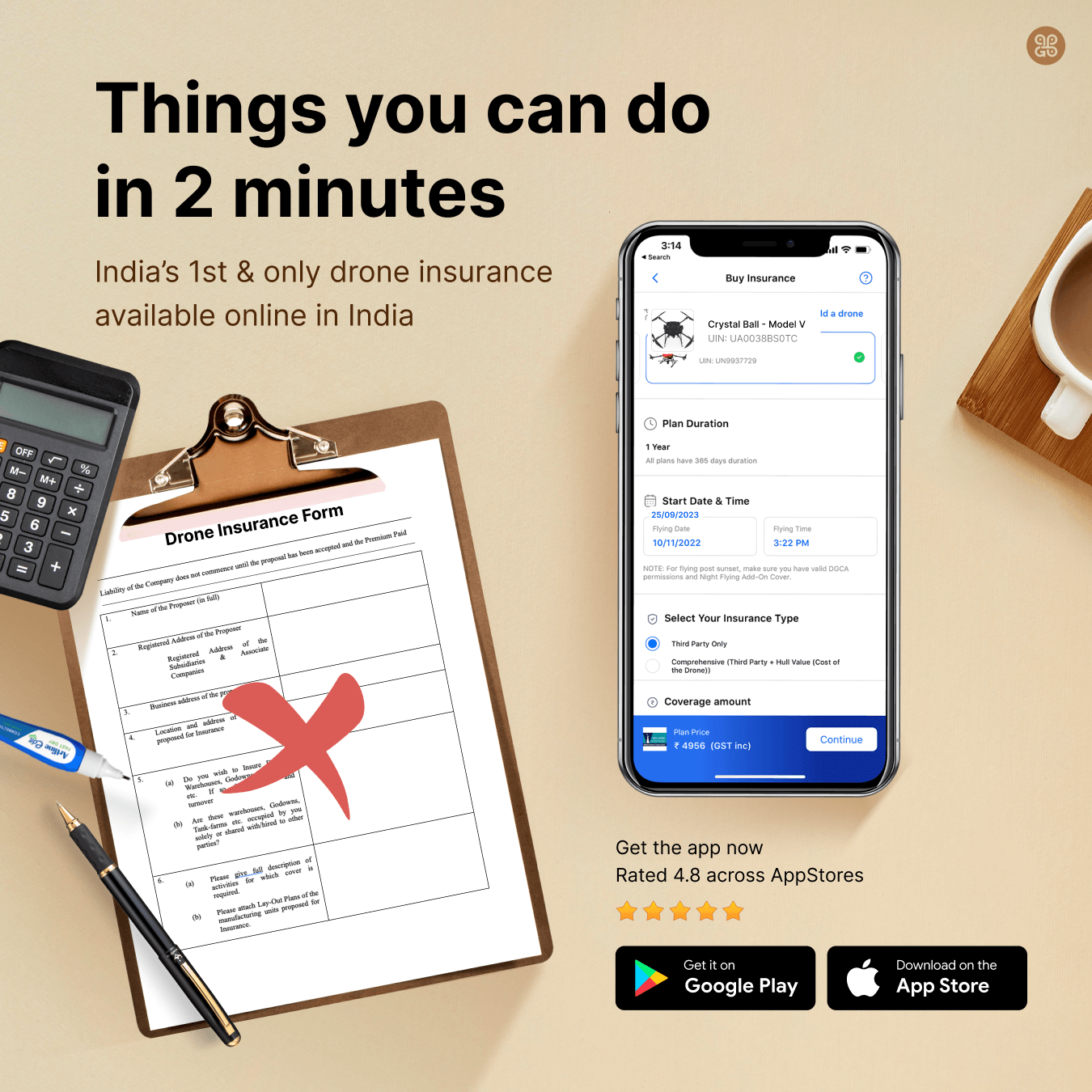

You can purchase Third Party Liability Drone Insurance in India from various insurance providers. Additionally, online platforms and insurance marketplaces provide convenient options for comparing policies and obtaining quotes. TropoGo is India's first and most trusted online drone insurance platform, offering policies from TATA AIG, Bajaj Allianz and National Insurance. You can buy online at affordable prices and get cover for your Third Party Liability Drone Insurance. It's advisable to research and choose a reliable provider with a strong track record in the drone insurance industry.

Tropogo is the exclusive platform where you can swiftly buy Drone Insurance online in just 2 minutes, To Know more, Click on the link below :

https://tropogo.com/insurance/drone

However, having a drone insurance policy is not enough. You also need to follow the drone rules and regulations, as well as the terms and conditions of your policy, to avoid invalidating your drone insurance. There are some common mistakes that drone operators make that can lead to the rejection of their claims or the cancellation of their policies. Here are some of them:

Operating a drone in India mandates compliance with regulations set forth by the Directorate General of Civil Aviation (DGCA). One of the pivotal requirements is obtaining the Unmanned Aircraft Operator Permit (UAOP). Failure to secure this permit before flying your drone can significantly impact your insurance coverage. The UAOP is a fundamental authorization that legalizes drone operations within Indian airspace. It ensures that drone pilots understand and abide by safety guidelines and regulations, contributing to overall airspace security.

Insurance providers often require evidence of this permit to validate coverage. Without the UAOP, insurers might deem your drone operations illegal, thereby invalidating your insurance policy. This means that any incidents or accidents involving the drone may not be covered, leaving you personally liable for damages or liabilities.

Providing incorrect or incomplete information during the application process can have serious repercussions on your insurance coverage. Insurance policies are based on the information provided by the policyholder. Any discrepancies between the information given and the actual situation can lead to complications, especially during the claims process. Insurers rely on the accuracy of the details provided to assess risks and determine premiums. Inaccurate information regarding your drone's specifications, its primary use, previous incidents, or modifications can result in denied claims or policy cancellations. Insurers might consider this as a breach of the contract, thereby invalidating the coverage when you need it the most.

Operating a drone comes with a set of responsibilities that extend beyond the thrill of flight. Ignoring safety guidelines and regulations established by the Directorate General of Civil Aviation (DGCA) in India can not only lead to potential accidents but also significantly impact your drone insurance coverage. The DGCA has laid down comprehensive guidelines for drone operations to ensure safety and security in the airspace. These regulations encompass restrictions on flight altitudes, no-fly zones near airports, military installations, and densely populated areas, as well as other safety protocols.

To Know more, Click on the link below :

https://tropogo.com/india-guides/drone-laws/generic-rules

Compliance with safety guidelines is not only a legal obligation but also a crucial aspect of responsible drone ownership. It ensures the safety of individuals, property, and the airspace at large. Additionally, it plays a pivotal role in upholding the validity of your insurance coverage.

Personal insurance policies typically cater to recreational or non-commercial drone usage. When drones are employed for commercial purposes, such as generating revenue or supporting business activities, a standard personal insurance policy may not provide adequate coverage. Recognizing the difference between personal and commercial drone usage is essential for safeguarding your assets and liabilities. Investing in specialized commercial drone insurance ensures comprehensive coverage that specifically addresses the risks inherent in professional drone operations. Failure to secure commercial drone insurance for business-related activities can result in denied claims and the nullification of coverage when incidents occur during commercial operations. Insurers may consider it a breach of contract if a personal policy is used for commercial endeavors, leaving the drone operator exposed to financial liabilities.

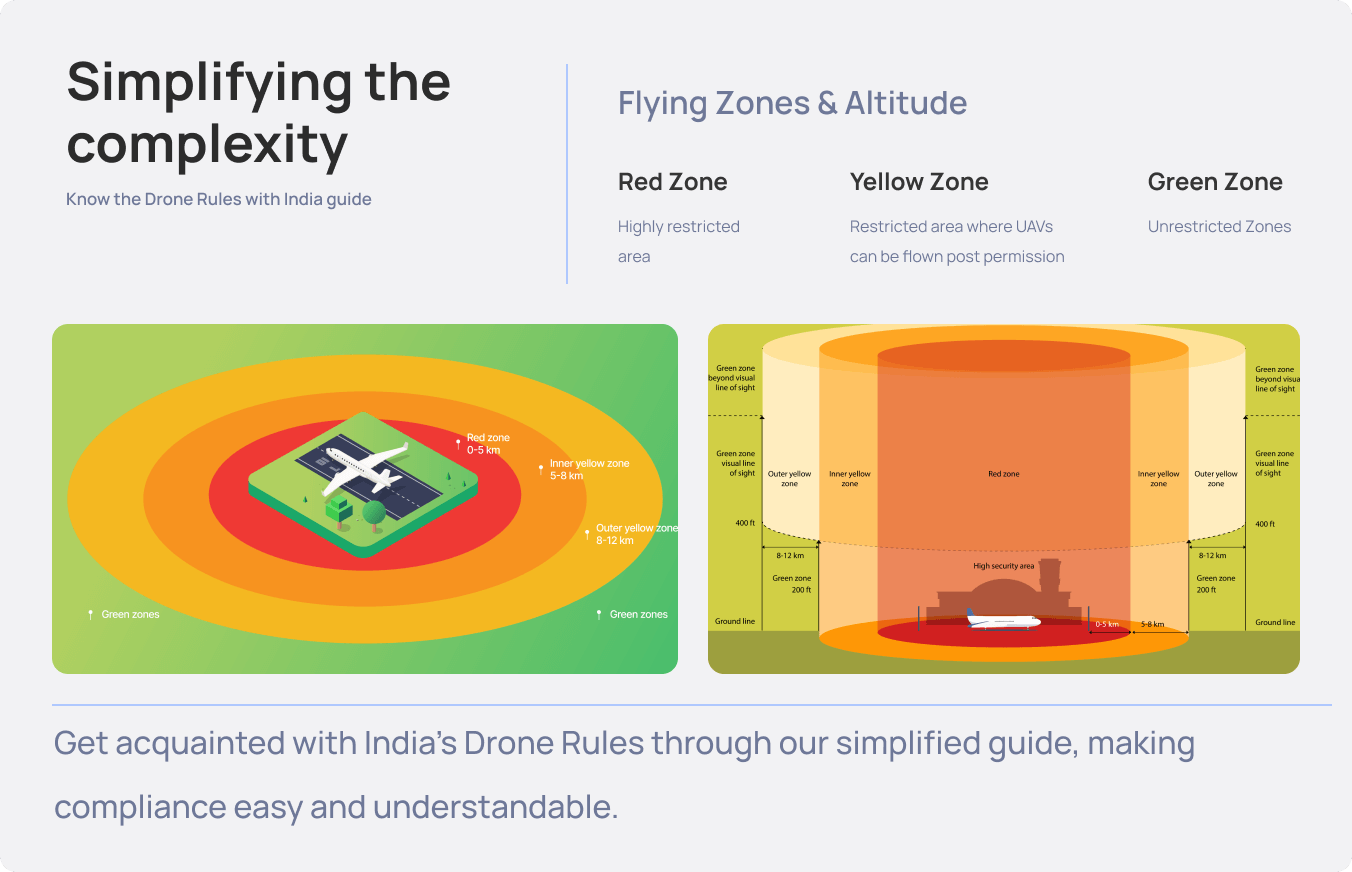

Flying a drone in “restricted” or "red" zones in India is a serious violation that can have severe implications, not just in terms of legal consequences but also regarding your drone insurance coverage.

Restricted zones, such as areas near airports, military installations, government buildings, and densely populated areas, have strict no-fly regulations for drones. These zones are marked as restricted due to safety, security, and privacy concerns.

Operating a drone in these restricted areas not only breaches government regulations but also poses significant risks, including the potential for accidents or interference with critical infrastructure. Such actions can compromise airspace safety and may lead to severe penalties or legal actions against the drone operator.

From an insurance standpoint, flying in restricted zones directly violates the terms and conditions of most insurance policies. Insurance providers typically specify adherence to regulations as a prerequisite for coverage. Therefore, if your drone is involved in an incident while flying in a restricted zone, your insurance claim may be denied.

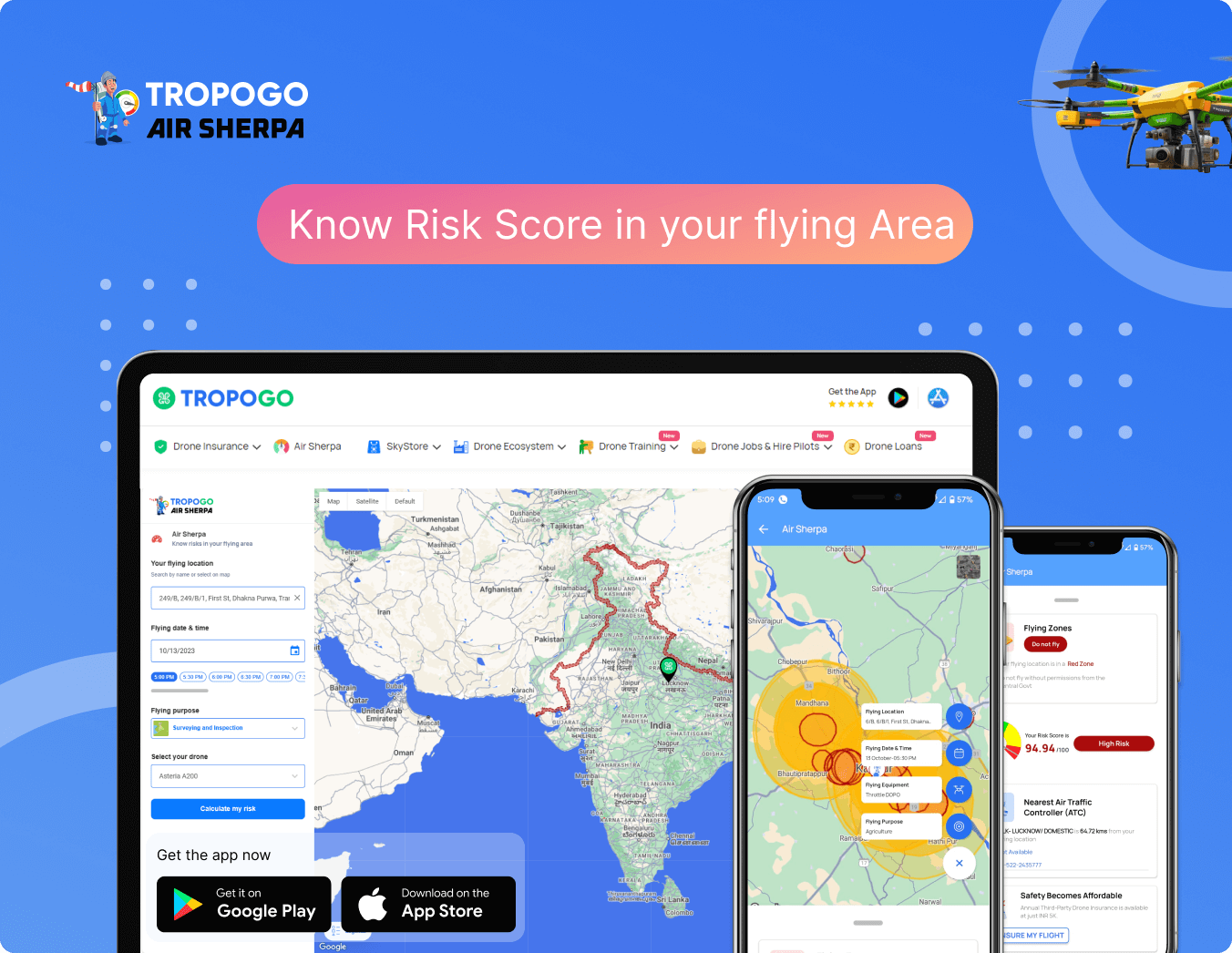

You can check the zones where you can fly your drone using the Air Sherpa feature on the TropoGo.

To Know more, Click on the link below :

Drone No Fly Zone Map India, Drone Flying Risk Score | Air Sherpa by TropoGo

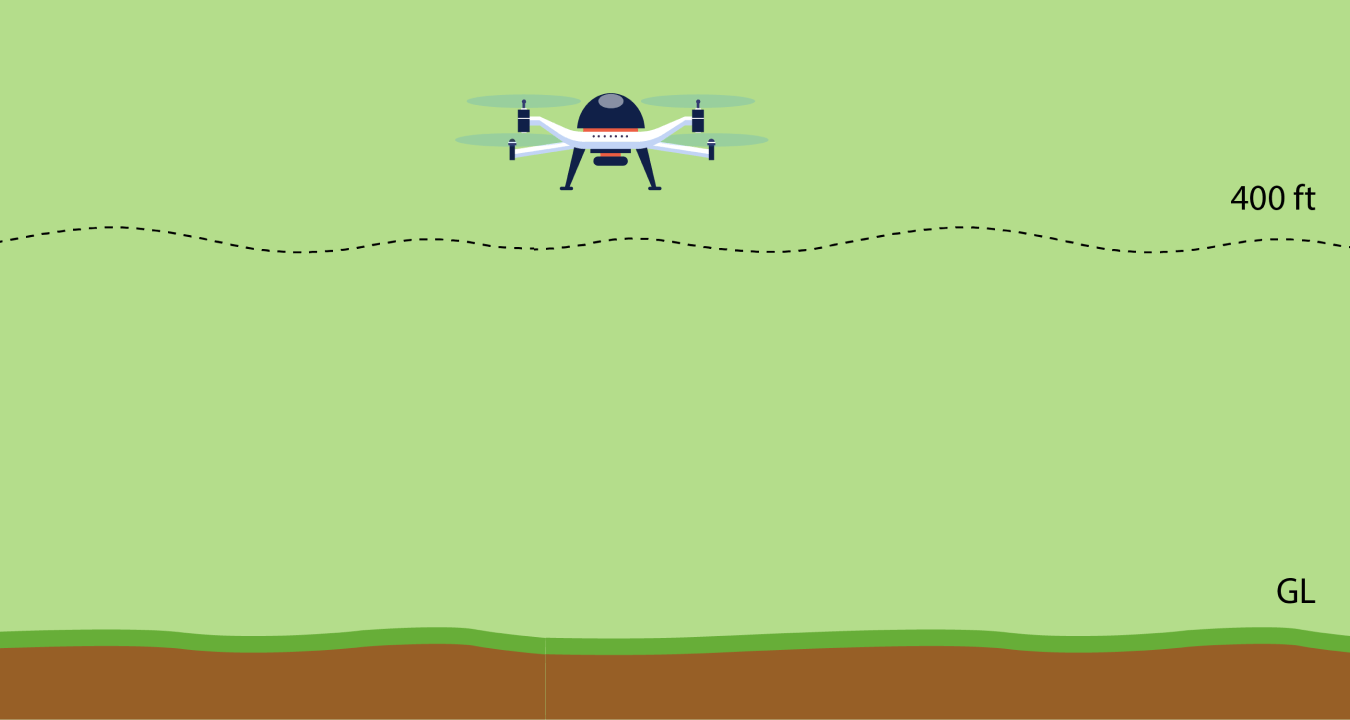

When operating a drone in India, adhering to altitude restrictions is critical. The Directorate General of Civil Aviation (DGCA) has specified altitude limits for drone flights, especially in "green" zones, which refer to areas with less population density and lower risk factors.

In the green zones, the maximum permissible altitude for drone flights is set at 400 feet above ground level. This limitation aims to ensure safety in airspace, prevent collisions with manned aircraft, and minimize risks to people and property on the ground.

If your drone operates above the permitted altitude and encounters an incident or accident, insurers might consider it a breach of the terms and conditions. Consequently, insurance claims related to incidents occurring above the specified altitude in the green zone may be denied.

Insurance providers view non-compliance with altitude restrictions as a negligent act, potentially leading to the nullification of coverage for damages, liabilities, or accidents resulting from flights above the designated limit.

Insurance providers view non-compliance with altitude restrictions as a negligent act, potentially leading to the nullification of coverage for damages, liabilities, or accidents resulting from flights above the designated limit.

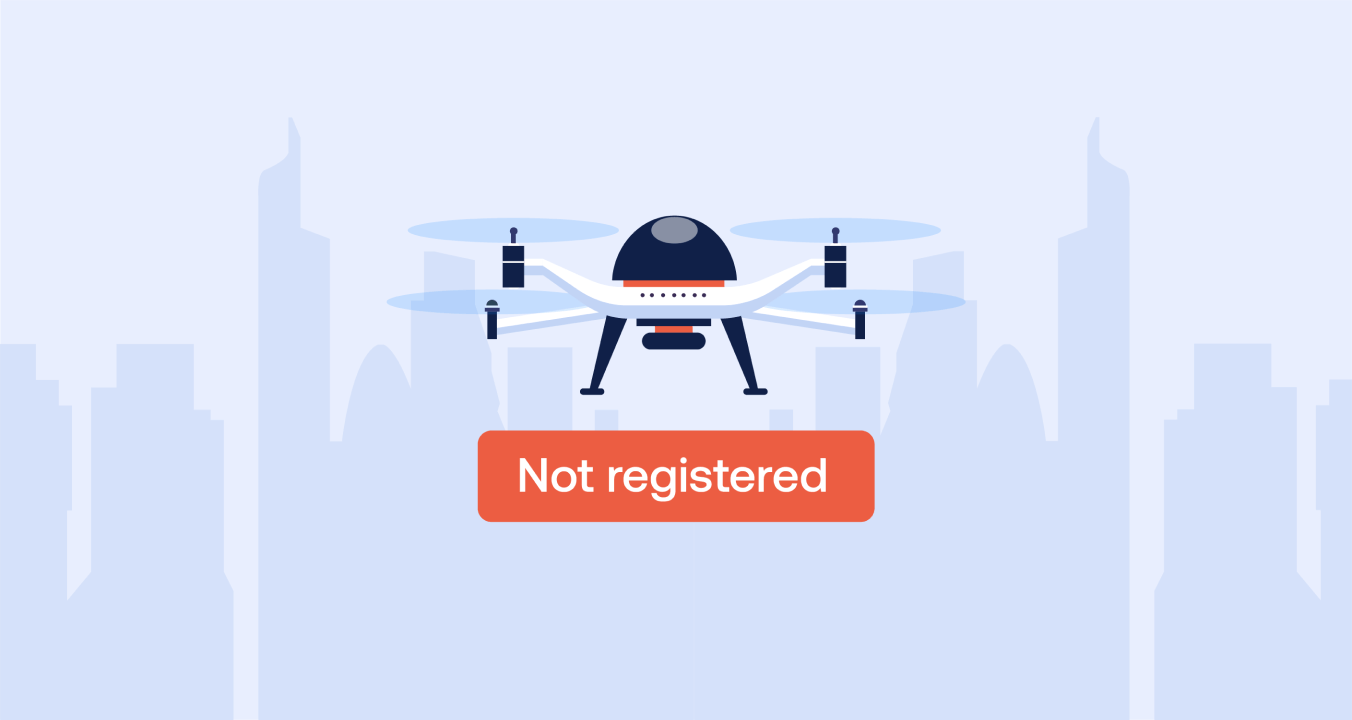

Engaging in illegal drone flights is a serious mistake that can have severe repercussions, not just from a legal standpoint but also concerning your drone insurance coverage in India.

This covers various scenarios where you fly your drone without following the legal requirements and procedures. For example, flying an unregistered drone, flying without a valid license or permit, flying without a valid drone insurance, flying in restricted areas or times, flying beyond visual line of sight (BVLOS) without permission, flying for commercial purposes without authorization, flying under the influence of alcohol or drugs, flying recklessly or negligently, etc. All these actions can invalidate your drone insurance, as well as expose you to legal consequences and penalties.

Drones, like any other machinery, require regular upkeep to ensure optimal performance, safety, and longevity. Neglecting maintenance not only increases the risk of technical failures but also jeopardizes your insurance coverage. Insurance providers often expect drone owners to demonstrate responsible ownership by conducting regular maintenance and inspections. A lack of upkeep might be perceived as negligence, potentially affecting your insurance claims in case of mishaps or accidents.

To ensure the validity of your drone insurance coverage and mitigate risks, establish a regular maintenance schedule. This should include checking components, updating firmware, inspecting the structure, cleaning, and verifying proper functionality before every flight.

Responsible drone ownership involves proactive maintenance, adherence to manufacturer guidelines, and a commitment to ensuring the airworthiness of your drone.

If you are involved in any accident or incident with your drone, such as a crash, a collision, a loss, a theft, a fire, a malfunction, a cyberattack, etc., you need to report it to your drone insurance provider as soon as possible, as well as to the relevant authorities, such as the DGCA, the police, the fire department, etc. You also need to provide all the necessary information and documents, such as the flight logs, the drone serial number, the drone acquisition number (DAN), the unique identification number (UIN), the remote pilot certificate, the third-party liability insurance certificate, the invoice bill, the images of the drone, etc. Failing to report or disclose any accident or incident, or providing false or incomplete information, can invalidate your drone insurance, as well as affect your future claims and premiums.

In conclusion, ensuring the validity of your drone insurance in India involves adhering to regulations, maintaining transparency with your insurer, and understanding the specific terms and conditions of your policy. By avoiding these common mistakes, drone owners can safeguard themselves against potential liabilities and ensure that their insurance remains valid when needed the most. Remember, being informed about regulations, flying responsibly, and maintaining clear communication with your insurance provider are fundamental steps in ensuring your drone insurance remains valid and effective.

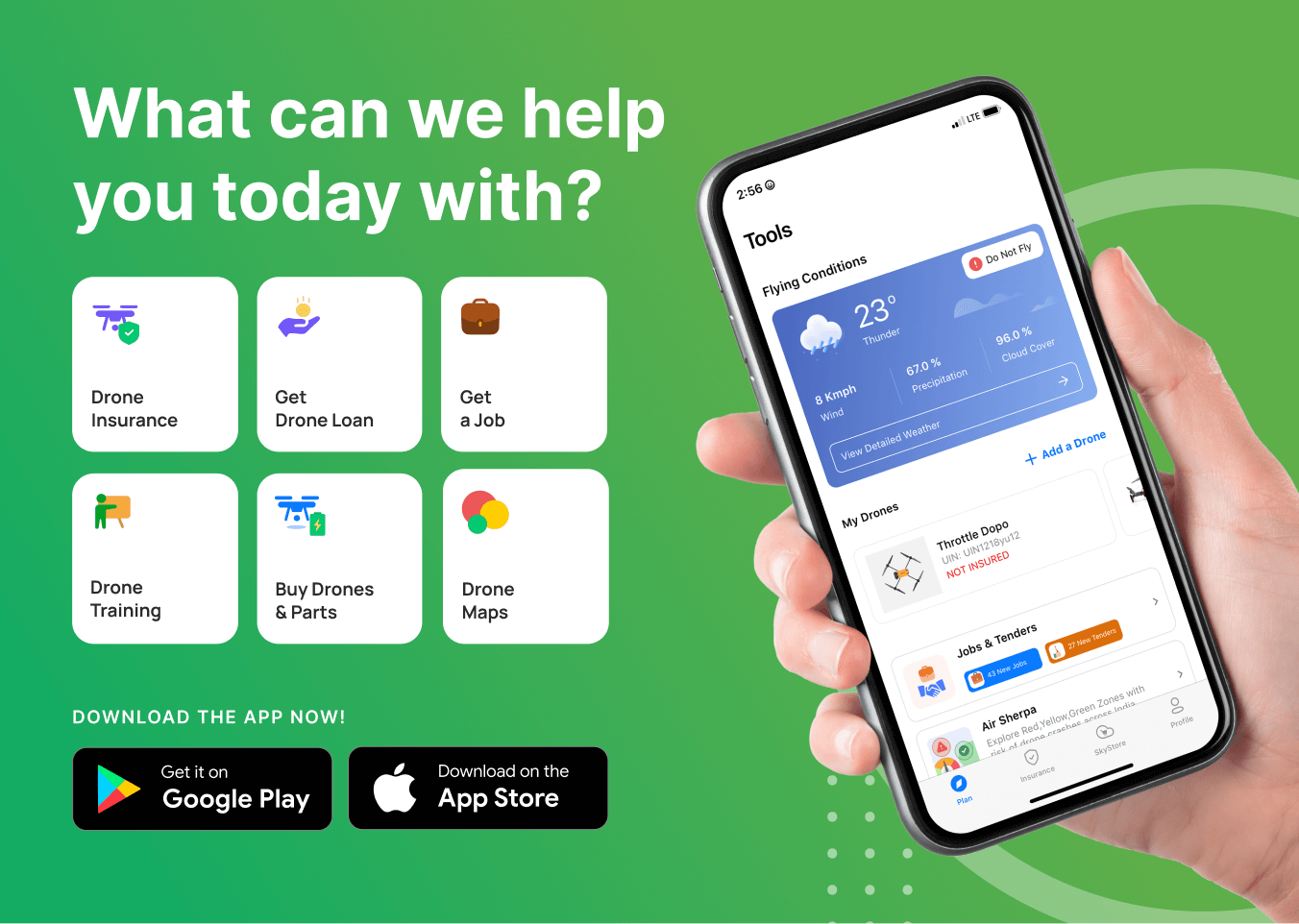

Download for Android : TropoGo-Drone Jobs & Tools - Apps on Google Play

Download for iOS : TropoGo-Drone Insurance & Jobs on the App Store (apple.com)