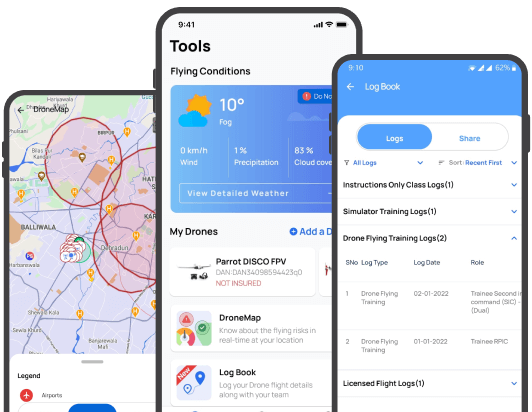

Drone Insurance

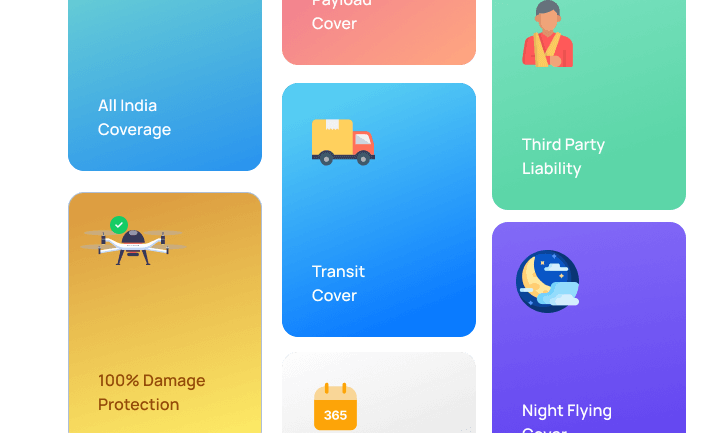

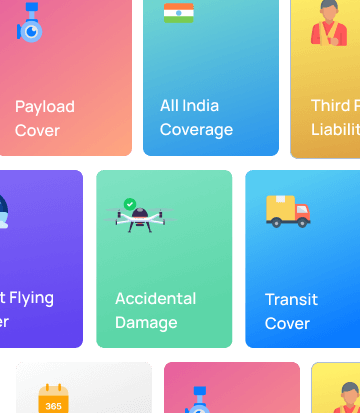

Get Drone InsuranceGet Third Party, Comprehensive, Payload Cover and many more cover

Personal Accident CoverCashless treatment at 7000+ hospitals & more

Hospicash InsuranceDaily cash allowance for hospitalization

BVLOS CoveragesCustom coverage for BVLOS flights

My CoveragesYour purchased drone coverages

FAQsAnswers to your insurance queries

Chat with us

Chat with us  Call us

Call us