In India, filing drone insurance claims requires a systematic approach. Start by promptly reporting the incident to your insurance provider, providing all necessary details. Document the damages with clear photographs and gather any relevant supporting documents. Adhere to any specified deadlines for claim submission. Finally, maintain open communication with your insurer throughout the process to ensure a swift resolution.

“In India, it is illegal to fly drones without Third-Party Liability Insurance.”

(Section 10: Drone Rules 2021, Ministry of Civil Aviation)

In this blog, we will cover the following points:

Filing a drone insurance claim in India involves several important steps to ensure a smooth and efficient process.

Here's a comprehensive guide on how to proceed:

As soon as an incident occurs that requires a claim, get in touch with your insurance provider promptly. Most insurance companies have a dedicated claims department, and you should find their contact information in your policy documents.

TropoGo :

Claims can be intimated directly by policyholders via

link- Insurance Dashboard | TropoGO

Also by Email Id : hello@tropogo.com

Contact Number: +917439324645

Bajaj Allianz :

Claims can be intimated directly by policyholders via

link- Commercial Insurance Claim | Bajaj Allianz

Also by Email Id : bagichelp@bajajallianz.co.in

Contact Number: 1800-209-0144 / 1800-209-5858

IFFCO Tokio :

IFFCO Tokio : Claims can be intimated directly by policyholders via

link- Register an Insurance Claim - Process (iffcotokio.co.in)

Also by Email Id : support@iffcotokio.co.in

Contact Number: 7993407777 / 1800-103-5499

National Insurance :

Claims can be intimated directly by policyholders via

link- NIC - National Insurance Company Limited Also by Email Id : customer.support@nic.co.in

Contact Number: 18003450330 / +9133-68110000 / +9133-25370070 / +9140-27700011

TATA AIG :

Claims can be intimated directly by policyholders via

link- Insurance Claim Status | Health, Motor, Travel, Marine Insurance | TATA AIG

Also by Email Id : customersupport@tataaig.com

Contact Number: 1800 266 7780 / 11800 22 9966

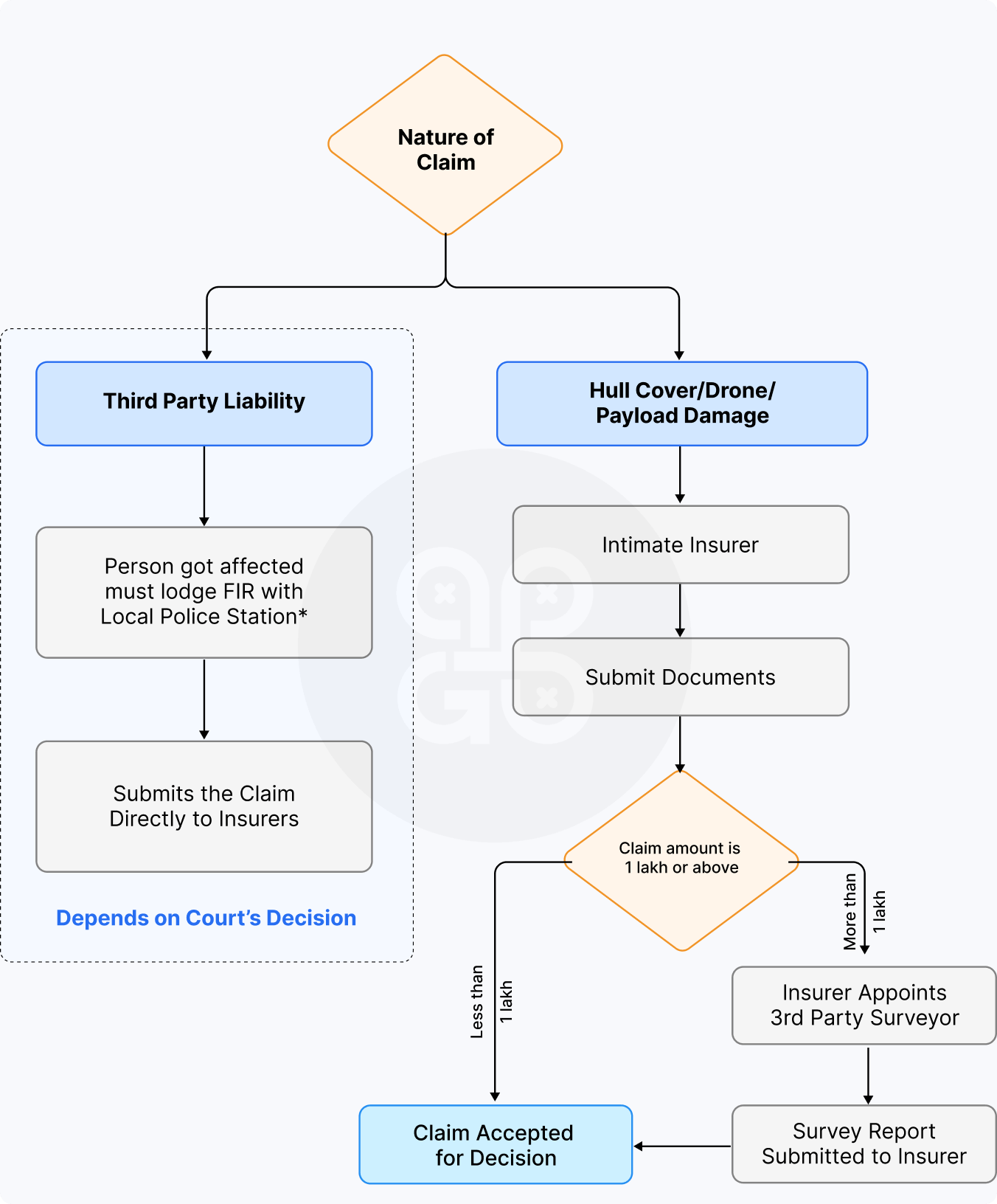

Your insurance provider will typically require you to complete a claims form. This form will ask for specific information about the incident and the extent of the damage or loss. Make sure to fill out the form accurately and completely.

When you contact your insurer, be prepared to provide essential information about the incident. This includes details such as the date, time, and location of the incident, a description of what happened, and any relevant photographs or videos.

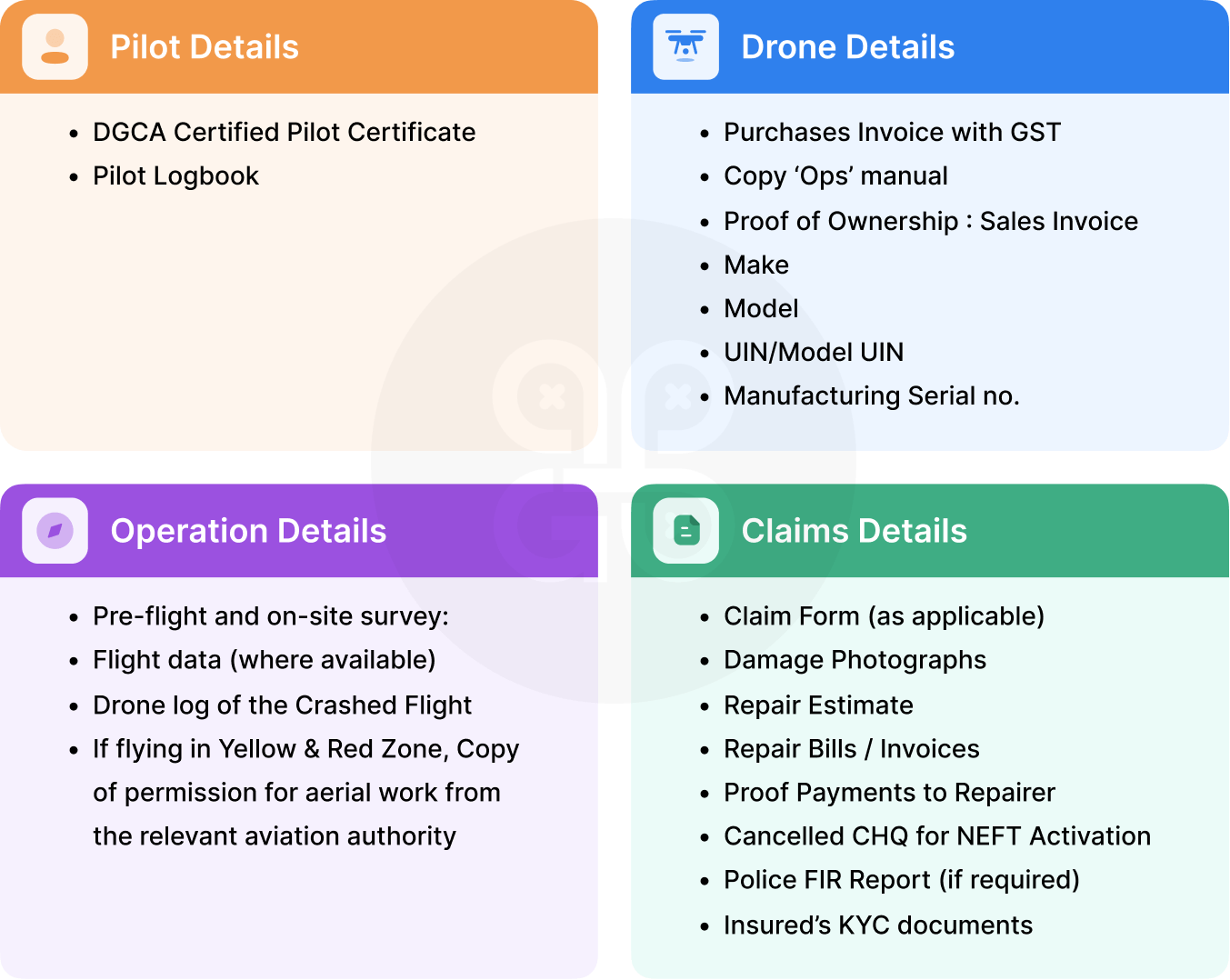

Insurers needs certain documents & evidential proofs to ascertain claims validity. These Information largely falls under 4 large Categories

In addition to this, there may be additional information that the insurer might request for claim processing.

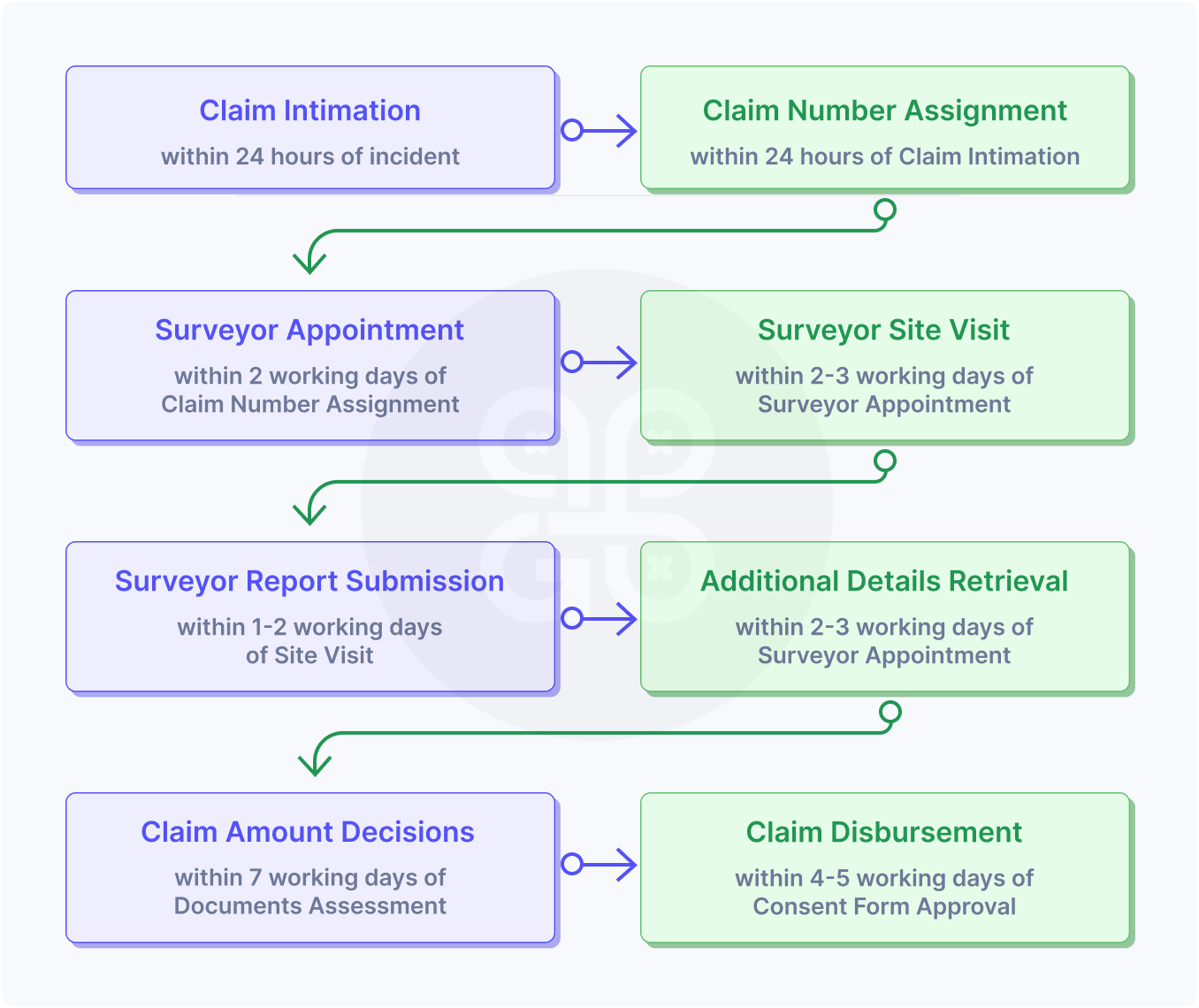

Upon intimation of the claim through the provided link, a claim number gets assigned. This claim number will serve as a reference for all future updates regarding the claim.

To proceed with your claim, you need to provide the clear images of the damaged drone. This visual documentation is crucial in assessing the extent of the damage accurately. Ensure that the photograph captures all affected areas for a comprehensive evaluation. Once submitted, claims team will expedite the processing of your claim.

In cases where the repair cost exceeds INR 1 Lakh, a surveyor will be appointed within 2 working days of intimation. The surveyor will contact and visit the site for inspection within 2-3 working days and assess the extent of the damage and determine the necessary repairs. This step ensures that the claim process is thorough and accurate, providing you with the necessary coverage for the repairs. Once the surveyor's report is submitted, we will proceed with the next steps in processing your claim.

After the assessment, The surveyor will share the detailed inspection report with the insurance company within 1-2 working days of his visit. This report contains crucial details about the damage assessment and recommended repairs, which are essential for processing your claim accurately. Once received, claims team will review the report and proceed with the necessary steps to facilitate the repair or replacement of your drone.

After 2 working days, the surveyor will reach out to the claimant again to retrieve the following details:

In certain cases, insurance company may require additional details to process your claim effectively. This could include specific information about the incident, witness statements, or any relevant documentation. providing these details promptly will expedite the claims process and ensure a swift resolution.

The claim amount determination involves a comprehensive assessment of the damages and associated costs. Claims team carefully reviews all submitted documentation, including surveyor reports and supporting evidence, to arrive at a fair and accurate valuation. Once the assessment is complete, Insurance company will promptly notify you of the approved claim amount.

Before proceeding with any repairs or disbursements, Insurance company require your consent. You'll be provided with a Consent Form outlining the details of the proposed actions and specifying the breakdown of the claim reimbursement. Review it thoroughly and provide your approval to move forward. Your consent ensures that all steps taken align with your preferences and expectations.

Before proceeding with any repairs or disbursements, Once all necessary approvals are obtained, the claim disbursement process begins. This involves the release of funds or arrangements for repairs, depending on the nature of the claim. Once the claimant approves the consent form, the claim amount is released into the claimant's account, typically within 4-5 working days the amount gets credited.

Deductibles are the amount claimant agree to pay towards a claim before your insurance coverage kicks in. This ensures a shared responsibility between you and the insurer.

If your claim is rejected or if you disagree with the settlement amount, you have the right to appeal or enter into a dispute resolution process with the insurer. This may involve negotiation or mediation to reach a fair resolution.

After a claim has been settled, it's a good time to review your insurance coverage. You may need to adjust your policy or consider additional coverage to better protect your drone operations in the future.

Remember that the specific process for filing a drone insurance claim can vary from one insurance company to another and may also depend on the terms and conditions outlined in your policy. It's crucial to familiarize yourself with your insurance policy and contact your insurer as soon as possible after an incident to ensure a smooth and timely claims process.

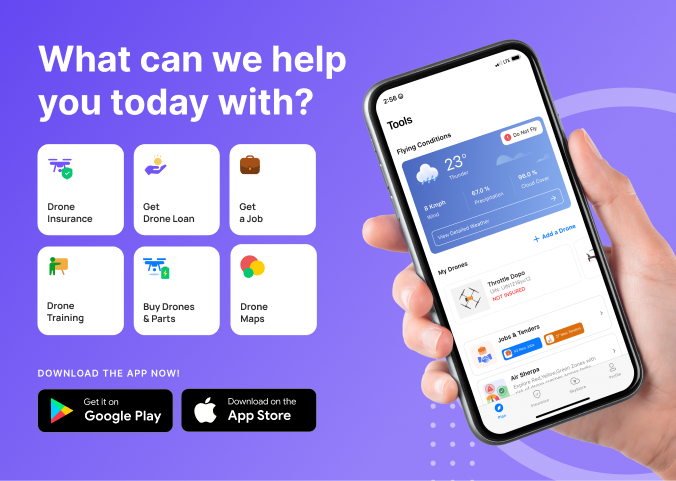

Tropogo is the exclusive platform where you can swiftly buy Drone Insurance online in just 2 minutes, To Know more, Click on the link below :

https://tropogo.com/insurance/drone

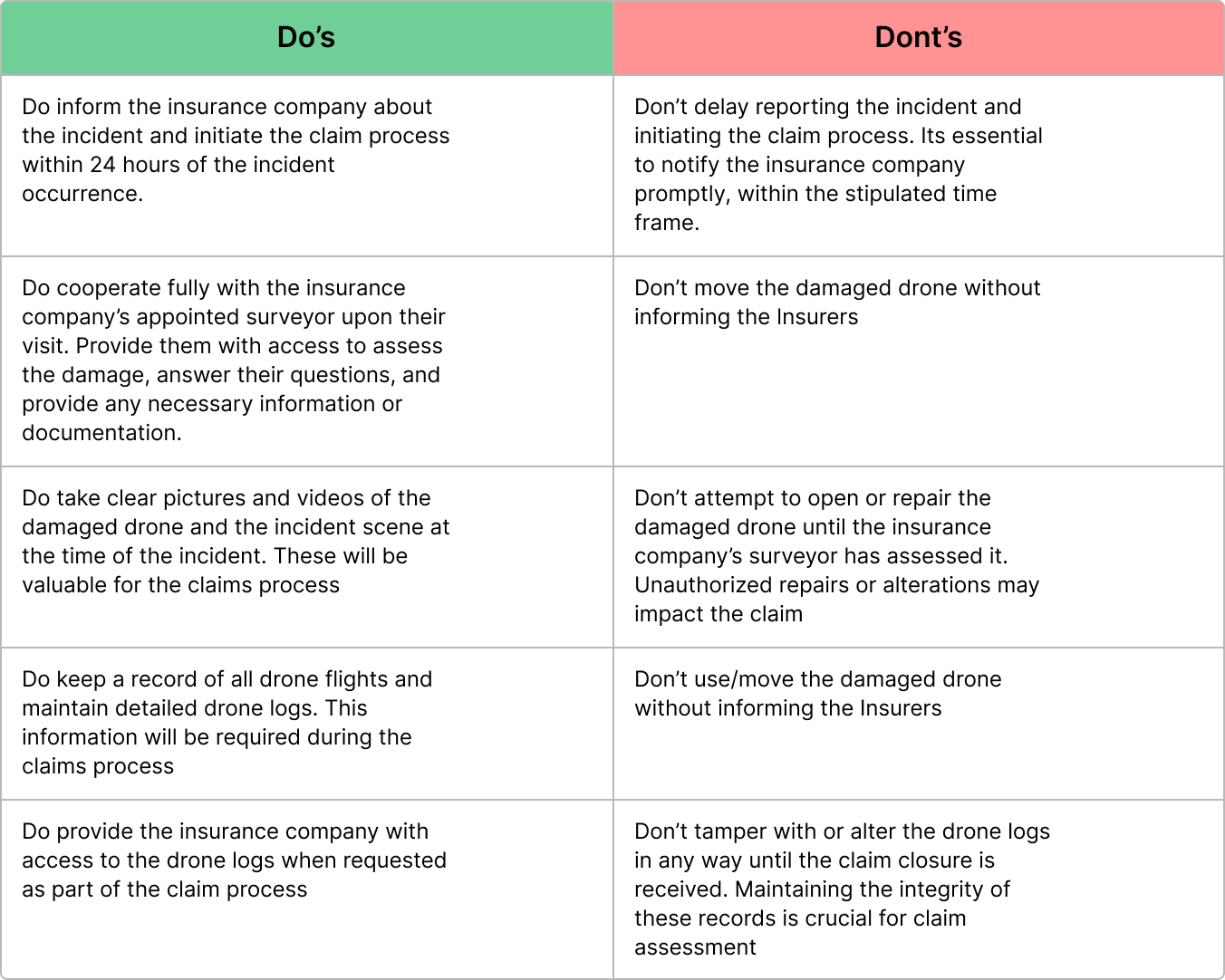

Best Practices for Drone Pilots to Ensure a Seamless Drone Insurance Claim Process in India.

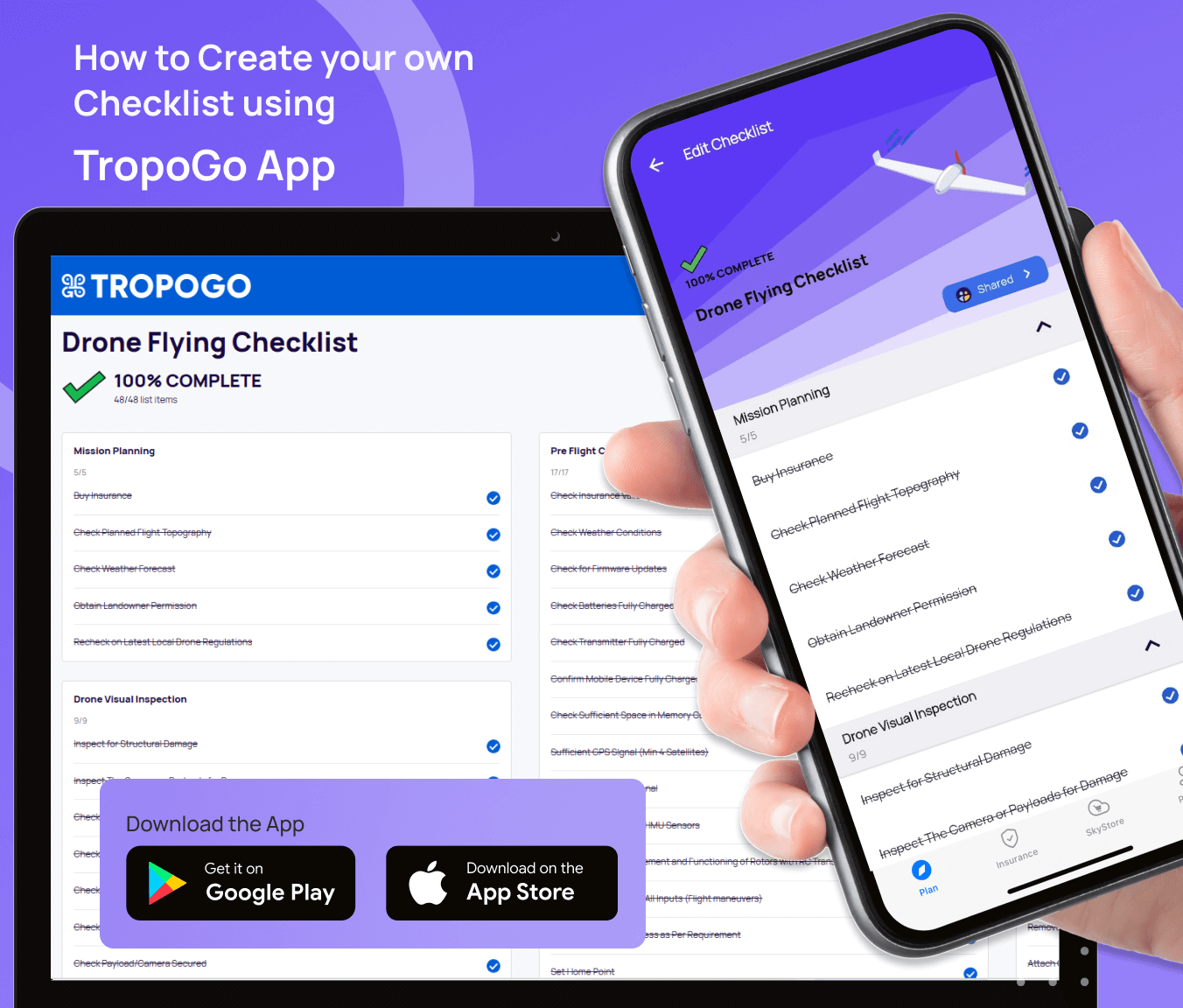

Implementing a pre and post-flight checklist is pivotal for a seamless drone insurance claim process. Prior to takeoff, the pre-flight checklist ensures thorough inspections and adherence to safety protocols. Post-flight, it verifies that all necessary steps are taken, aiding in the accuracy and efficiency of the claims procedure. These checklists serve as indispensable tools in maintaining a high standard of safety and facilitating a smooth insurance claims experience for drone operators. Adherence to these procedures is paramount in the realm of drone operation and insurance.

To Create your Checklist, Click on the Download button above

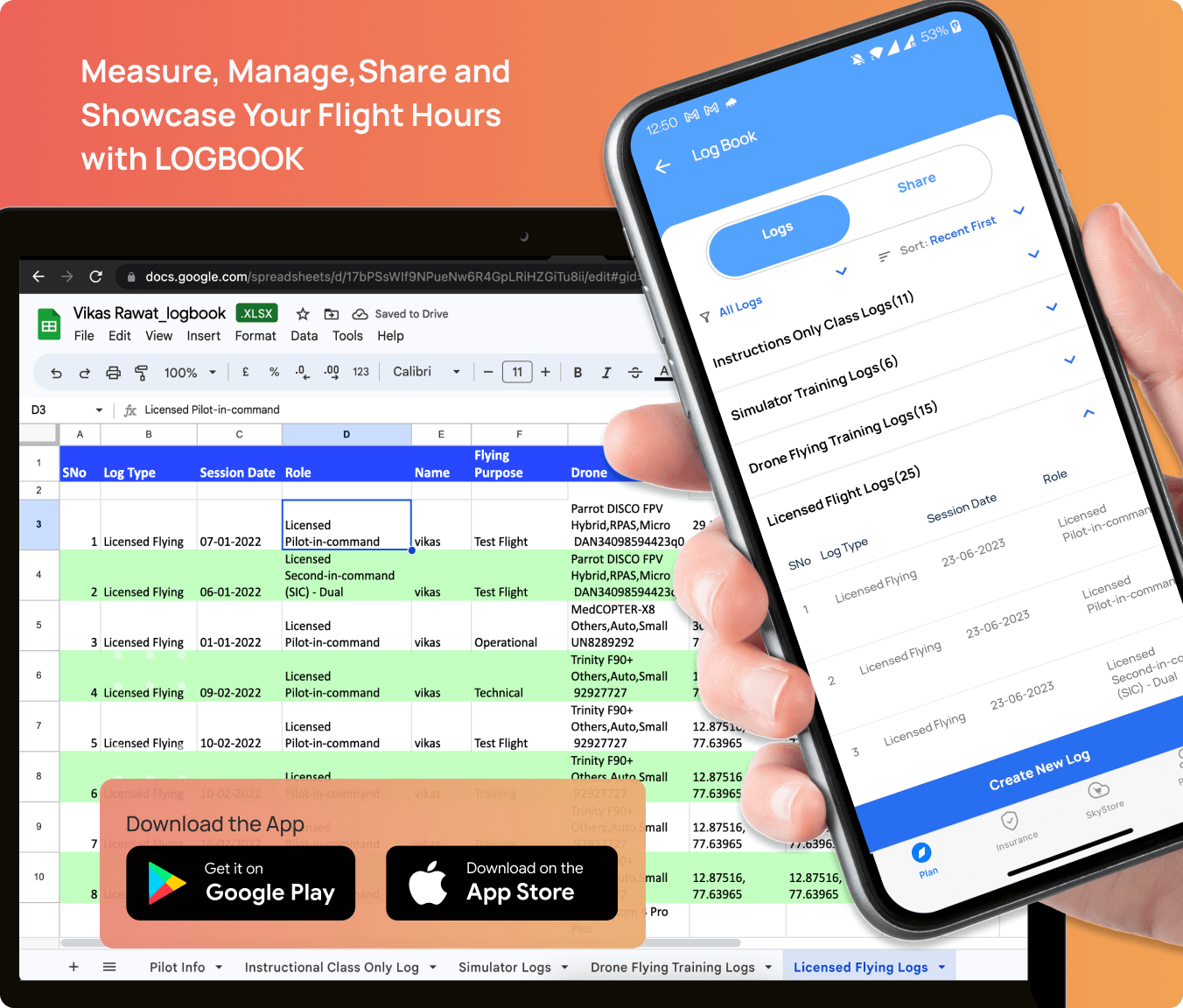

Keeping a detailed logbook is crucial for a seamless drone insurance claim process. It serves as a comprehensive record of all flights, providing critical information in case of incidents. Documenting pre-flight checks, flight details, and post-flight procedures ensures accurate reporting. This meticulous record-keeping is invaluable in expediting the claims process and demonstrating responsible drone operation.

To Create your Checklist, Click on the Download button above

Keeping an up-to-date maintenance book is integral for a seamless drone insurance claim process. This record serves as a comprehensive account of all maintenance activities undertaken on the drone. Documenting repairs, servicing, and inspections ensures accurate reporting in case of an incident. By maintaining an organized and accessible maintenance book, you contribute to a smooth claims experience and demonstrate responsible drone ownership.

Maintaining a log of your drone's battery charge cycles is essential for claims processing. This record provides valuable information about the battery's usage and performance. It serves as a crucial reference in case of battery-related incidents or claims. By keeping an organized charge cycle log, you contribute to a seamless claims experience and demonstrate responsible drone ownership.

Performing routine maintenance on your drone is crucial for a seamless insurance claim process. Regular upkeep ensures that the drone is in optimal condition, reducing the likelihood of accidents. It also demonstrates responsible ownership, a key factor in the claims assessment. By prioritizing regular maintenance, you not only enhance safety but also streamline the claims process in the event of an unforeseen incident.

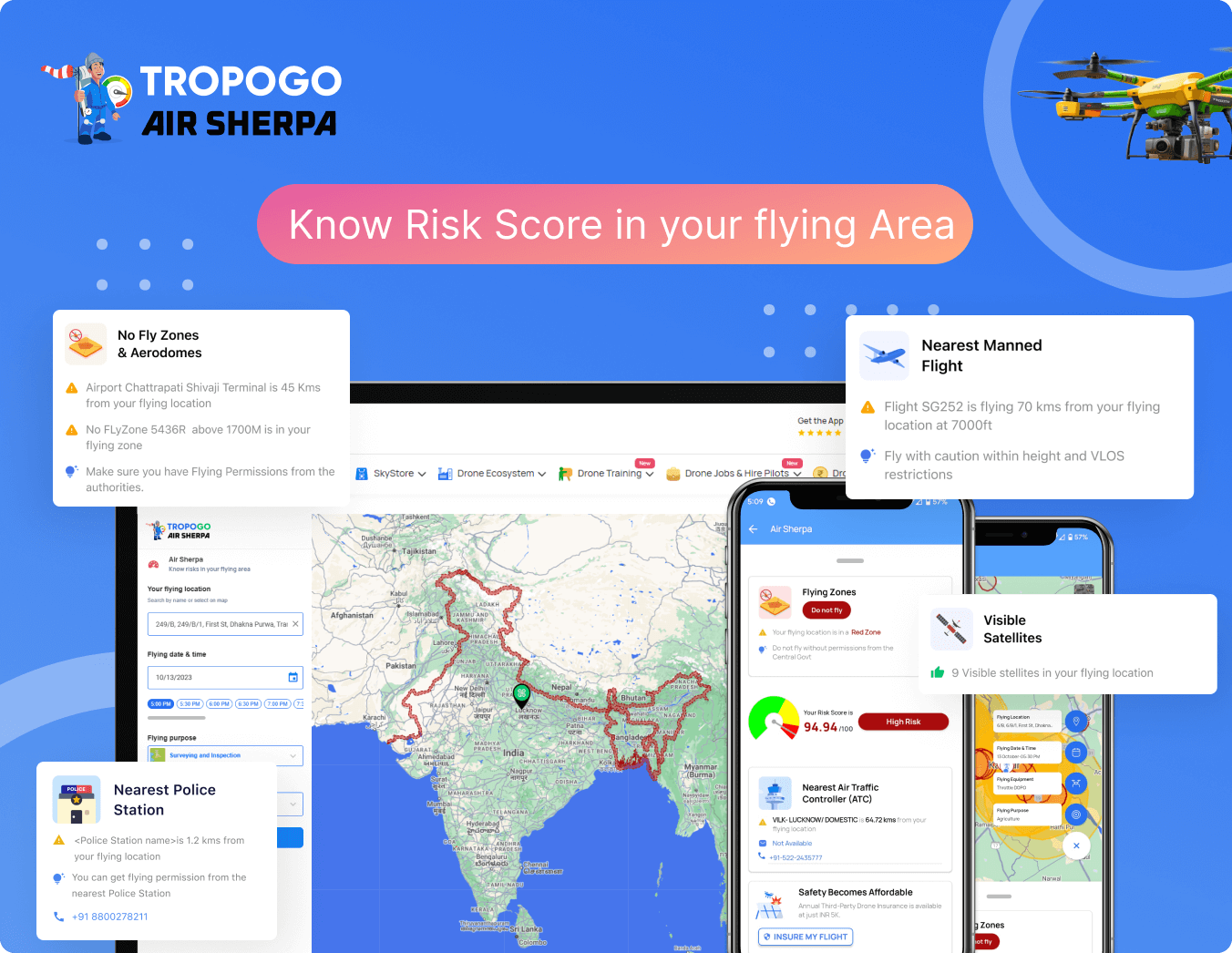

Performing a diligent pre-flight check of the flying location or designated zones is essential for a seamless drone insurance claim process. This step guarantees that the area is secure and compliant with regulatory guidelines. It significantly reduces the risk of accidents or incidents during flight operations. By prioritizing this precautionary measure, you play a vital role in facilitating a smooth claims experience while showcasing responsible drone operation.

To Know more, Click on the link below :

Drone No Fly Zone Map India, Drone Flying Risk Score | Air Sherpa by TropoGo

Remember that drone insurance is essential for responsible drone operations in India. It not only protects your investment but also safeguards against potential legal liabilities in case of accidents or incidents involving your drone. Always consult with insurance professionals and carefully read policy terms and conditions before making a decision.

Download for Android : TropoGo-Drone Jobs & Tools - Apps on Google Play

Download for iOS : TropoGo-Drone Insurance & Jobs on the App Store (apple.com)