In today's rapidly-evolving tech landscape, drones have moved beyond novelties to become vital tools across industries. They are used for critical infrastructure checks, capture high-resolution aerial imagery and collect precise data. Yet, with great opportunities come high risks. Drone insurance steps in as a crucial safety measure, ensuring pilots can navigate uncertainties with confidence. In India, regulatory requirements underline its importance. This guide simplifies drone insurance, giving you the knowledge to fly securely while meeting mandatory regulations.

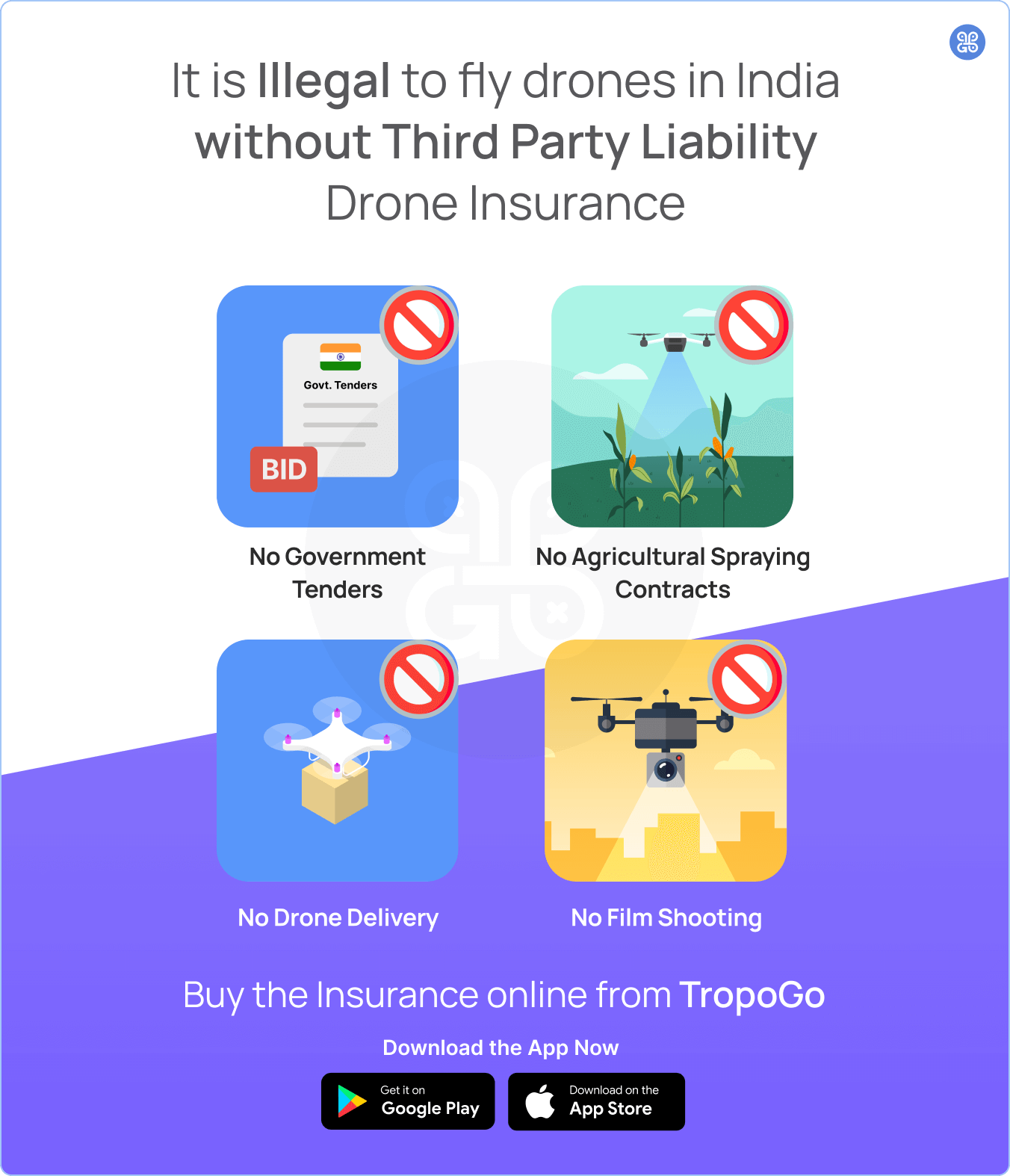

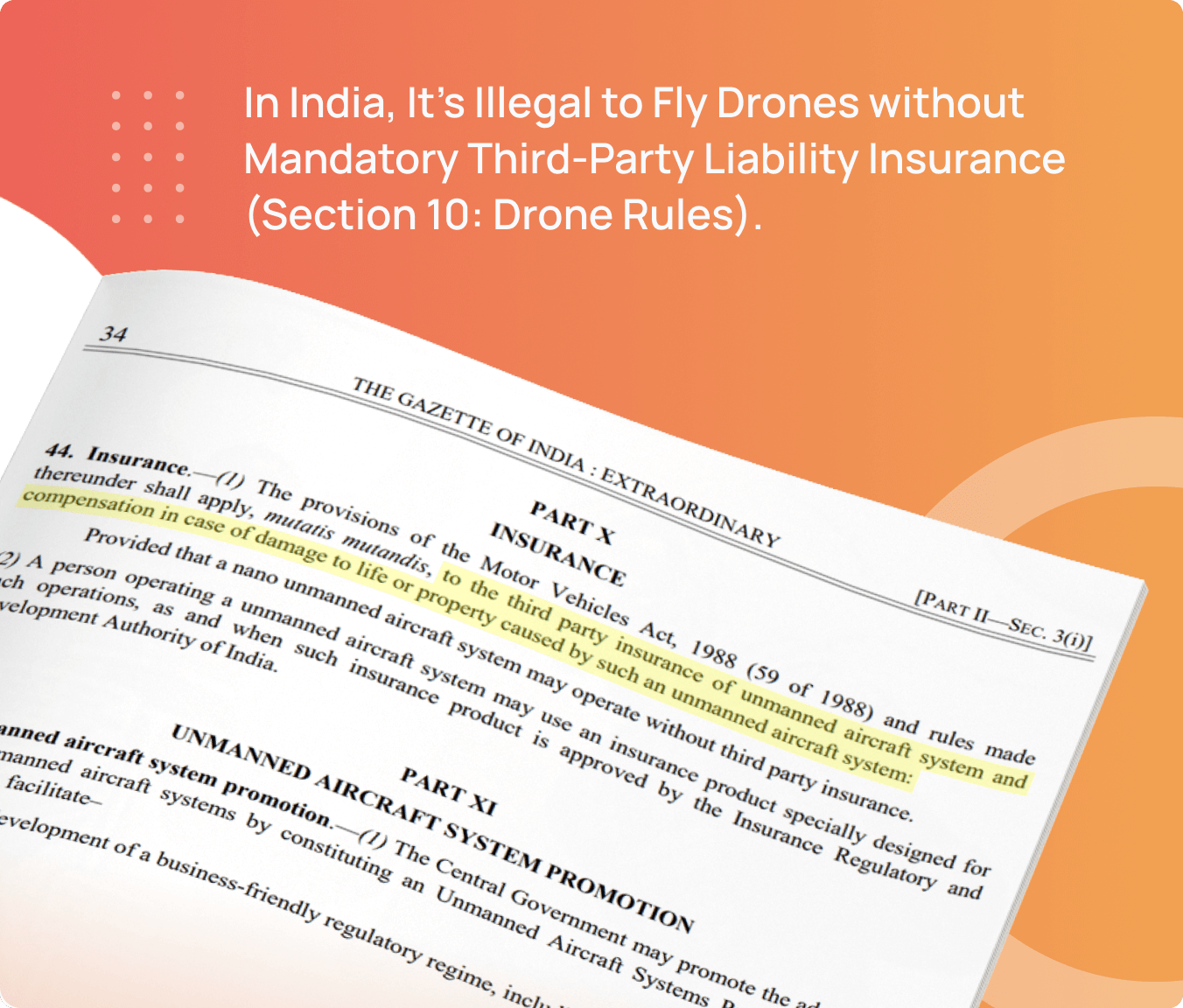

“In India, it is illegal to fly drones without Third-Party Liability Insurance.”

(Section 10: Drone Rules 2021, Ministry of Civil Aviation)

In this blog, we will cover the following points:

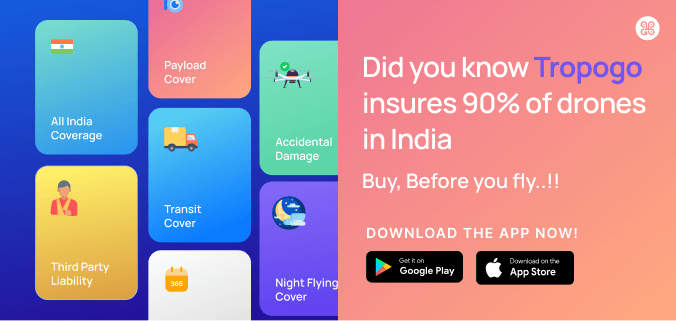

Drone insurance is a specialized form of financial risk protection tailor-made for individuals who operate drones, whether as pilots or owners. It serves as a safeguard, offering financial assistance in the event of accidents, damages, or liabilities arising from drone operations. Just as automobile insurance provides coverage for accidents and collisions on the road, drone insurance plays a similar role in mitigating potential risks linked to drone flights.

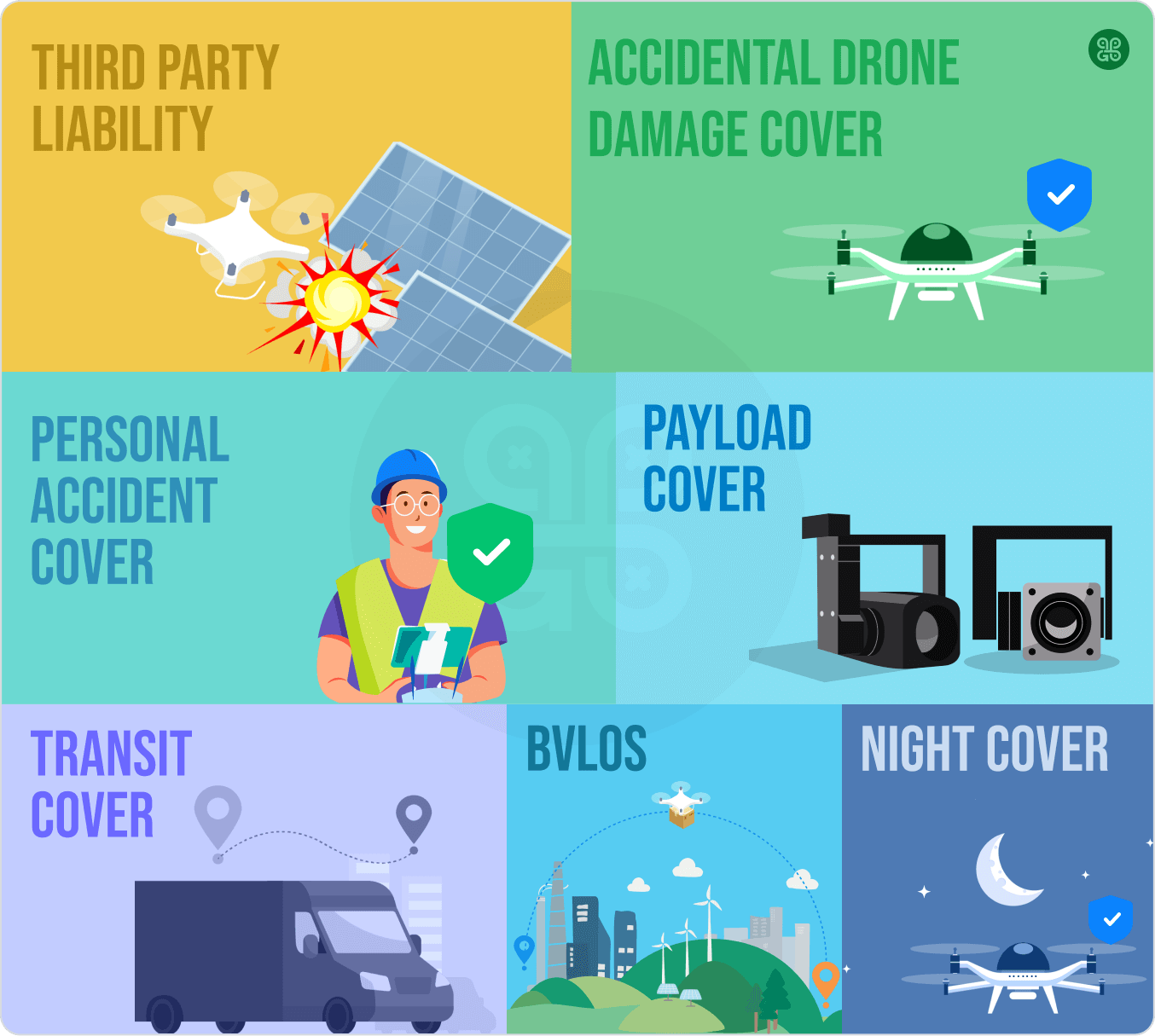

Drone insurance typically covers several key areas:

This type of insurance encompasses various aspects of drone activities, including recreational and commercial uses. Whether you are a hobbyist capturing stunning landscapes or a professional using drones for business purposes, having drone insurance means you are prepared for the unexpected.

This covers damage or injury to third parties and their property caused by your drone.

For example, a drone operator conducts aerial surveys near a construction site. Suddenly, the drone malfunctions and collides with a parked car, resulting in significant damages to the car. Without insurance, the operator would be personally responsible for the repairs. However, with third-party liability insurance, these costs will be covered, sparing the operator a financial burden.

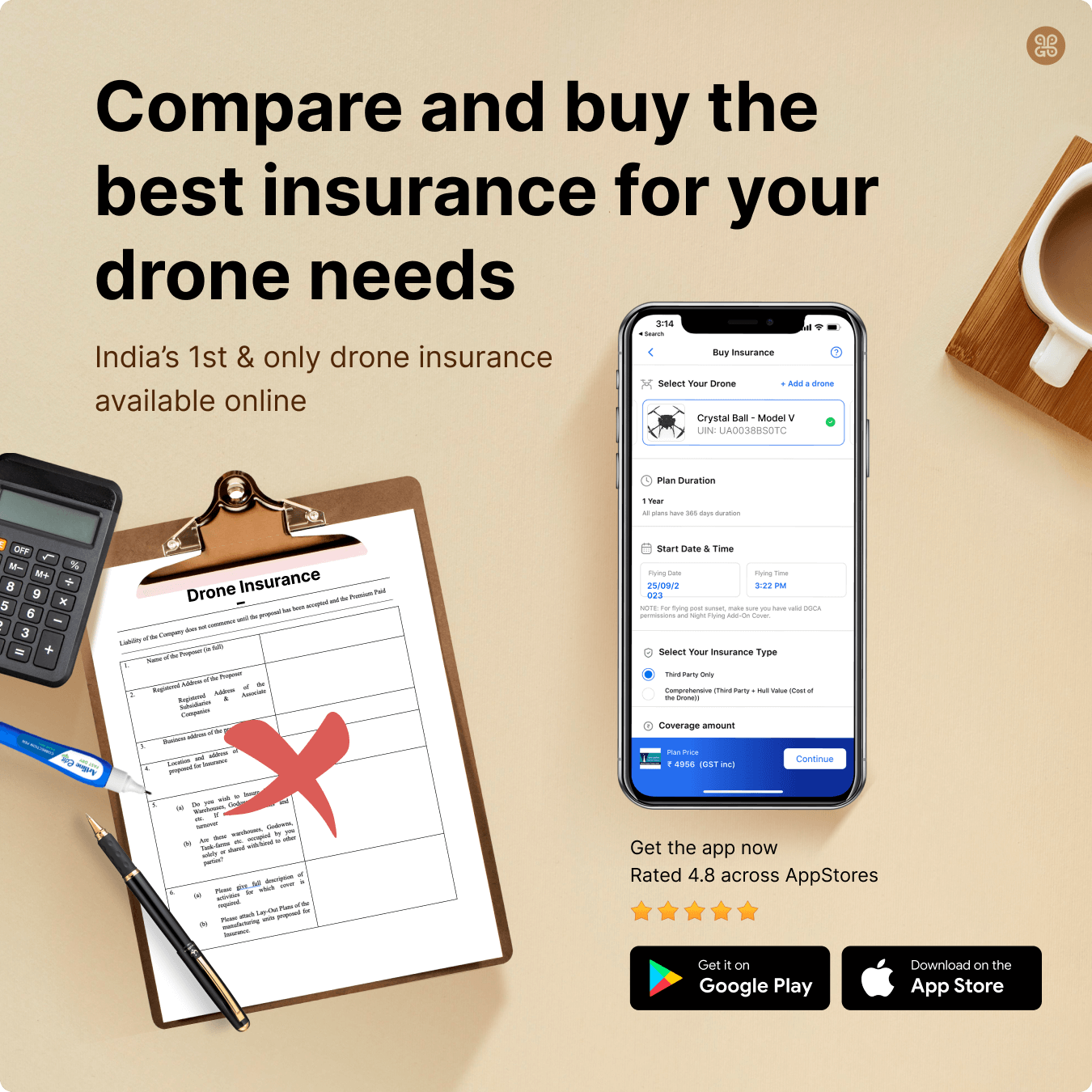

India’s 1st & only drone insurance available online,

To Know more, Click on the link below :

https://tropogo.com/insurance/drone

Why you should buy Third-Party Liability Drone Insurance ?

In India, having third-party liability insurance for drone operations is mandatory. It ensures legal compliance and safeguards against accidents, providing financial security for unforeseen expenses. Moreover, it builds trust and professionalism by demonstrating a commitment to safe and responsible drone use.

How much does the Third-Party Liability Drone Insurance cost in India?

The cost of Third-Party Liability Drone Insurance in India can vary based on several factors that include type of drone, its usage (commercial or recreational), coverage limits, and the insurer's policies. For Third-Party Liability Drone Insurance coverage, annual premiums can range from INR 5,000 to INR 20,000.

Where can you buy Third-Party Liability Drone Insurance in India?

You can purchase Third-Party Liability Drone Insurance in India from insurance providers and online platforms. Online platforms provide convenient options for comparing policies and obtaining quotes.

TropoGo is India's first and most trusted online drone insurance platform, offering policies from IFFCO-Tokio, TATA AIG, Bajaj Allianz and National Insurance. You can buy online at affordable prices and get cover for your Third-Party Liability Drone Insurance.

Tropogo is the exclusive platform where you can swiftly buy Drone Insurance online in just 5 minutes, To Know more, Click on the link below :

https://tropogo.com/insurance/drone

Also known as "Hull Coverage”, this covers damage to your drone itself, whether due to accidents, crashes, or other covered events.

For example, a professional drone operator capturing aerial footage of a construction site. While manoeuvring through tight spaces, the drone unexpectedly collides with scaffolding, leading to a sudden crash. Without Accidental Drone Damage Cover, the operator would be solely accountable for the repair or replacement expenses of the drone.

Why you should buy Accidental Drone Damage Cover ?

This coverage provides financial protection in case of accidents, such as collisions, crashes, or technical failures. Without one, the cost of repairing or replacing your drone could be substantial. With Accidental Drone Damage Cover, you can continue your operations with confidence, knowing that you have a safety net in place.

How much does the Accidental Drone Damage Cover cost in India?

The cost of Accidental Drone Damage Cover in India varies based on factors like the type of drone, its usage (commercial or recreational), coverage limits, and the insurance provider's policies. Generally, annual premiums can range from INR 7,000 to INR 30,000 for basic coverage.

Where can you buy Accidental Drone Damage Cover in India?

In India, Accidental Drone Damage Cover is available through various insurance providers, TropoGo leads as India's reliable online drone insurance platform with easy policy comparisons and quotes. offering policies from esteemed insurance partners. Here, you can conveniently purchase coverage at budget-friendly rates for your Accidental Drone Damage Cover.

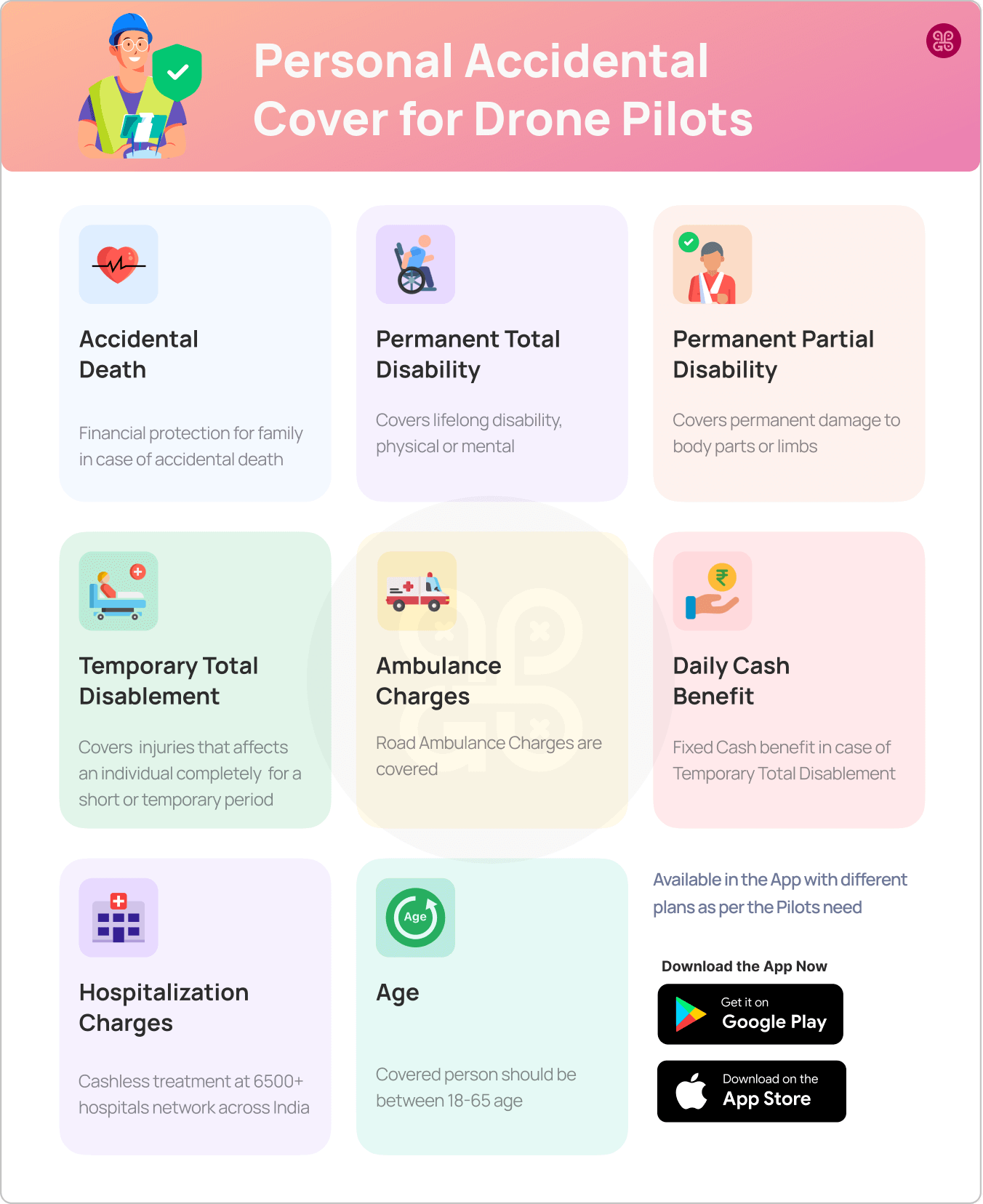

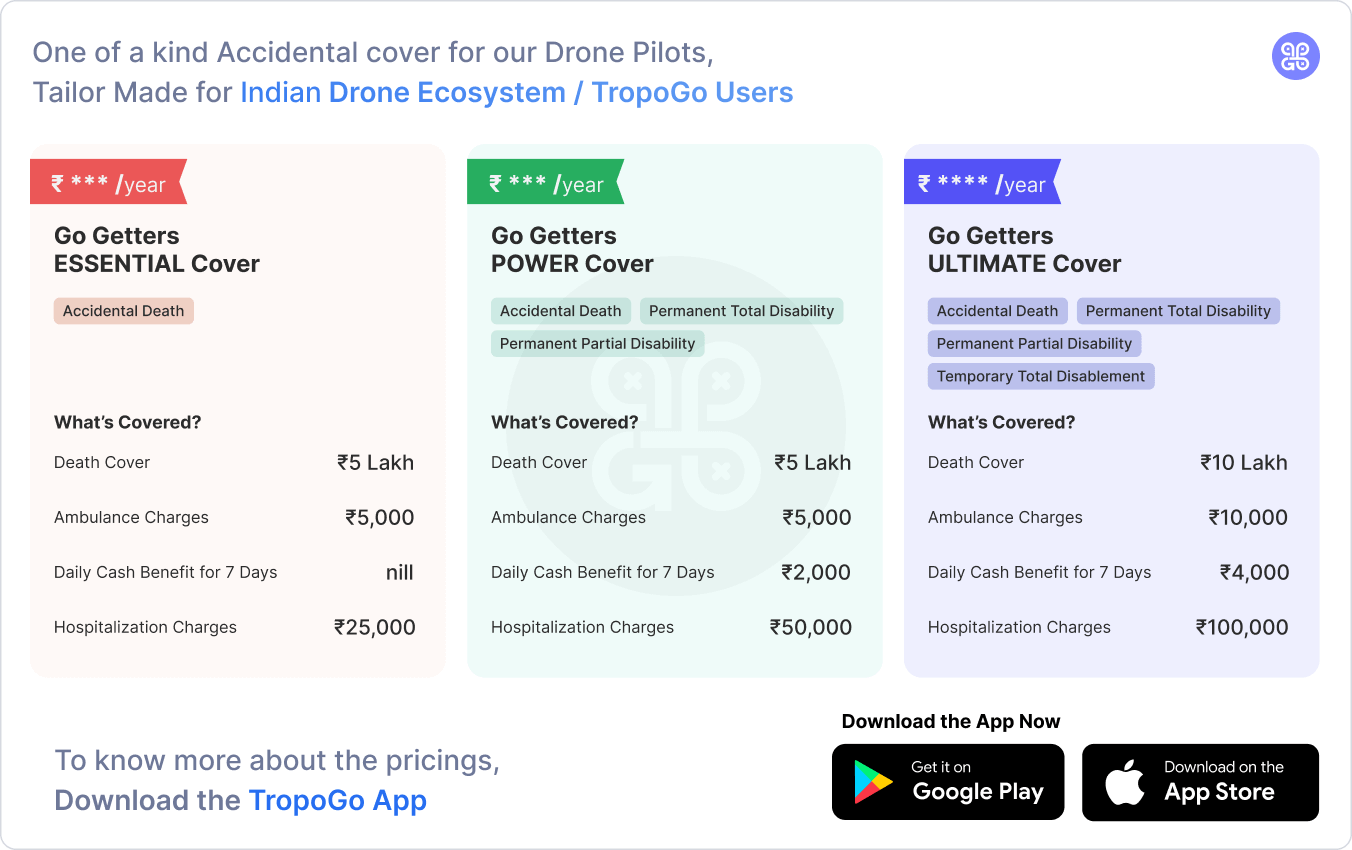

Personal Accident Cover for drone pilots is a critical aspect of drone insurance in India. It provides financial protection in the event of injuries, disability or death. while operating a drone.

For example, a drone pilot inspecting a tall under-construction building. While carefully flying around, the drone suddenly loses control and crashes near pilot due to a complex manoeuvre. Unfortunately, the pilot sustains injuries requiring medical attention and a period of recovery.

Why should you buy Personal Accident Cover?

Drones, while operated remotely, can still pose risks to operators or crew members. Personal injury coverage offers financial support in case of injuries sustained during drone operations, ensuring that medical expenses and potential loss of income are covered.

Government tenders and many private contracts often require drone pilots to have Personal Accident Cover. This demonstrates professionalism and a commitment to safety, instilling trust with clients and partners.

How much does the Personal Accident Cover cost in India?

The cost of Personal Accident Cover for drone pilots in India can vary depending on factors such as coverage limits, pilot experience, and the insurer's policies. On average, annual premiums can range from INR 500 to INR 2,000.

Where can you buy Personal Accident Cover in India?

You can buy Personal Accident Cover in India from reputable insurance providers and online platforms. Online marketplaces like TropoGo offers specialized policies tailored to the needs of drone pilots. It is essential to research and select a trustworthy provider with a proven track record in the drone insurance sector.

Payload Cover is essential for drone pilots in India as it protects valuable equipment attached to the drone during operations.

For example, a drone equipped with costly camera & Lidar equipment crashes due to unforeseen wind conditions. Without Payload Cover, the pilot would face significant financial responsibility.

Why should you buy Payload Cover?

Acquiring Payload Cover in India is essential for safeguarding the valuable equipment attached to your drone during operations. In case of unexpected incidents, such as a crash or damage, this coverage ensures that repair or replacement costs for payload are covered. Without one, you could face a substantial financial burden. This protection not only secures your equipment but also supports uninterrupted and professional drone operations.

How much does the Payload Cover cost in India?

The cost of Payload Cover in India depends on factors like the value and type of equipment being covered, as well as the insurer's policies. On average, annual premiums can range from INR 5,000 to INR 15,000. However, for high-value or specialized equipment, the premiums may go higher.

Where can you buy Payload Cover in India?

You can purchase Payload Cover in India from established insurance providers and online platforms. TropoGo offers specialized policies tailored to protect valuable equipment attached to drones during operations. It's crucial to conduct thorough research and choose a reliable provider with a strong track record in the drone insurance industry.

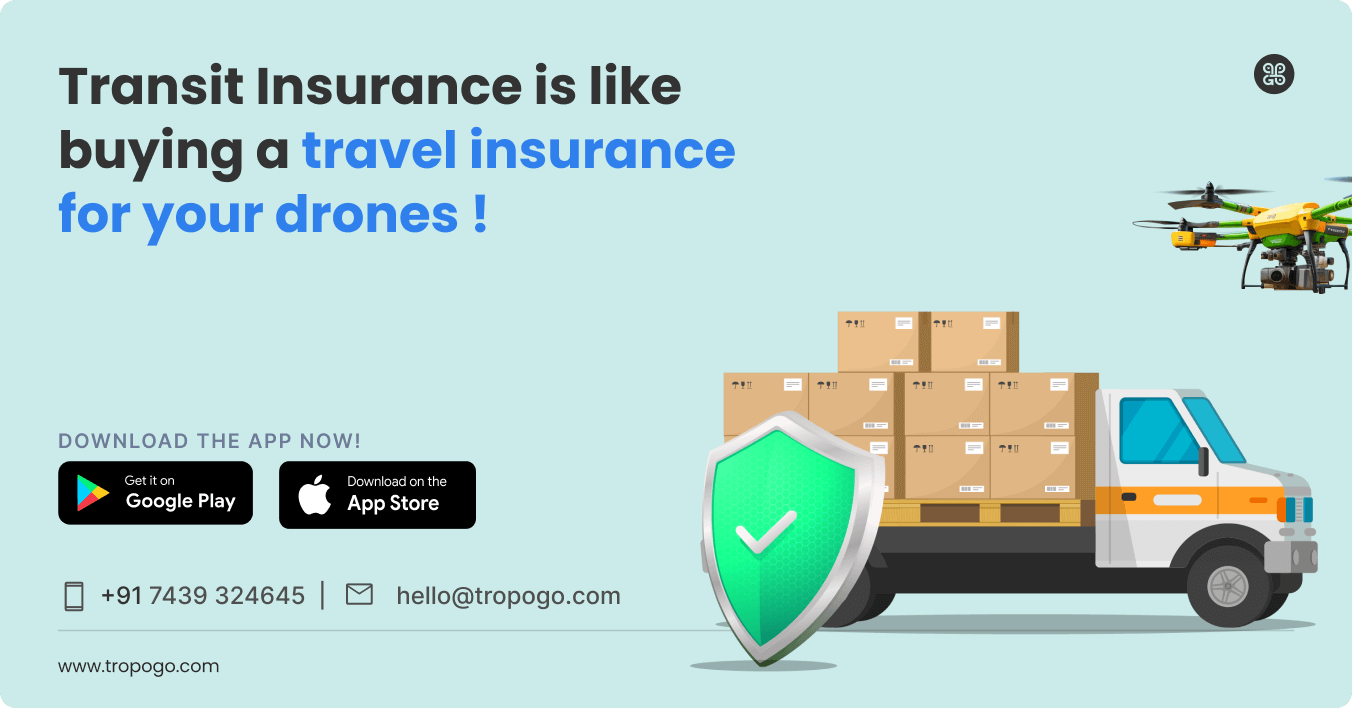

Drone Transit Cover is crucial for protecting your drone during transportation.

For example, during transit to an industry expo, a drone may incur damage. With Drone Transit Cover, the expenses for repair or replacement would be taken care of, preventing unexpected financial strain.

Why should you buy Transit Cover?

Investing in a Drone Transit Cover is essential for safeguarding your drone during transportation. It provides financial protection in case of unexpected damage or mishaps during transit. Without this protection, the owner would be liable for the costs. This coverage is a crucial aspect of responsible drone ownership in India, providing peace of mind for various professional applications.

How much does the Transit Cover cost in India?

The cost of Drone Transit Cover in India varies depending on factors like the value of the drone, coverage limits, and the insurance provider's policies. On average, annual premiums can range from INR 4,000 to INR 8,000. However, for specialized or high-value drones, premiums may be higher. It's essential for drone owners to consult with insurance providers and compare policies to find the most suitable and cost-effective option for their specific needs.

Where can you buy Transit Cover in India?

You can purchase Transit Cover for drones in India from reputable insurance providers and online platforms. Established insurers offer specialized policies tailored to protect your drone during transportation. Online marketplaces like TropoGo provide a convenient avenue for comparing policies and obtaining quotes.

Explore & Compare the tailormade Drone Insurance online in one place,

To Know more, Click on the link below :

https://tropogo.com/insurance/drone

Add-on covers are additional benefits that you can add to your insurance policy. These add-ons increase your premium but at the same time decrease any financial burden that you are likely to incur in case of an accident. It is therefore advised to purchase add ons based on your drone operation requirements.

Beyond Visual Line of Sight (BVLOS) cover in drone insurance refers to a specific provision that extends coverage to drones operating outside the visual range of the pilot. This means the drone can fly beyond what the pilot can directly see with their naked eye. BVLOS operations are considered riskier due to reduced direct oversight, and this cover provides protection for potential incidents or accidents that may occur during such flights. It is an important aspect of drone insurance for operators engaged in BVLOS operations, ensuring they have financial protection in case of unforeseen events.

Night Flying Cover in drone insurance refers to a specific provision that extends coverage to drones operated during night time hours. This means the drone can be flown after sunset and before sunrise, when visibility is reduced compared to daylight conditions. Night time operations are considered riskier due to reduced visibility, and this cover provides protection for potential incidents or accidents that may occur during such flights. It is an important aspect of drone insurance for operators engaged in night flying, ensuring they have financial protection in case of unforeseen events. Best suited for drone flights that take place between sunset and sunrise.

All approved Beyond Visual Line of Sight drone operations & Night Flying operations must consider these insurance add-on. Avail TropoGo’s guidance to customize your add-on covers.

Drone insurance is not only a practical necessity but also a means of ensuring responsible and safe drone operations. By having proper coverage, you're not only protecting your investments but also contributing to the overall safety of the airspace and those who share it.

As drones take flight across the vast landscapes of India, their potential for innovation and transformation is becoming increasingly evident. From monitoring crop health to aiding in disaster relief, drones offer diverse applications that touch lives in myriad ways. However, amidst this exciting journey, the importance of drone insurance in India cannot be overstated. It serves as a crucial pillar that upholds safety, responsibility, and the seamless integration of drones into the nation's airspace.

India's Directorate General of Civil Aviation (DGCA) has implemented regulations to ensure safe drone operations. For commercial drone operations, insurance is a mandatory requirement. This regulatory demand underscores the commitment to responsible flying and aligns with international aviation standards.

In India, it is illegal to fly drones without Third-Party Liability Insurance (Section 10: Drone Rules 2021, Ministry of Civil Aviation).

Accidents can occur regardless of skill level. A sudden technical glitch, a moment of misjudgment, or unpredictable weather conditions can lead to collisions, damages, or even third-party injuries. Drone insurance acts as a safeguard, minimizing the financial impact of unexpected incidents. It covers repair costs, liabilities, and potential legal expenses, allowing operators to focus on operations rather than worrying about potential financial setbacks.

For instance, a high-end drone which can cost upwards of INR 10 lakhs. In the event of a mishap, repair or replacement costs could be significant. Moreover, statistics indicate that drone accidents have been on the rise, with an increase of 20% reported in the last year alone. These figures underscore the importance of having comprehensive drone insurance coverage.

Drone insurance encourages responsible operations. Knowing that they're covered in case of accidents, pilots are more likely to adopt cautious flying practices. This creates a ripple effect of safe behavior, reducing the chances of accidents and contributing to overall airspace safety.

For pilots, drone insurance isn't just a necessity; it's a mark of professionalism. Clients and partners value operators who prioritize safety and are prepared for contingencies. Insurance coverage enhances the credibility of operators, engaged in drone services, ultimately boosting client trust and partnerships.

In India's diverse landscape, drones are revolutionizing various industries like Construction, Land Survey, Agriculture, Mining, Infrastructure Development and surveillance. While they bring great potential, they also carry risks. Drone insurance allows pilots to innovate without the fear of major losses, fostering an environment for growth and experimentation, crucial for pushing the boundaries of technology.

Individual pilots, too, benefit immensely from drone insurance. Whether enthusiasts capturing scenic vistas or professionals performing complex aerial surveys, insurance offers them the freedom to push their boundaries. It provides the assurance that their investments are secure and that they're ready to tackle challenges head-on.

Whether you're a hobbyist capturing artistic shots or a professional pushing the boundaries of innovation, drone insurance is your partner in flight. By comprehending coverage options, premium determinants, and the claims process, you're equipped to make informed decisions that protect your investments, passions, and aspirations. So, as you ascend into the Indian skies, remember that drone insurance is your co-pilot, ensuring your flights are not only exhilarating but also secure. Embrace the thrill of piloting while knowing that you're backed by the safety net of drone insurance.

Download for Android : TropoGo-Drone Jobs & Tools - Apps on Google Play

Download for iOS : TropoGo-Drone Insurance & Jobs on the App Store (apple.com)