Drone Insurance

Get Drone InsuranceGet Third Party, Comprehensive, Payload Cover and many more cover

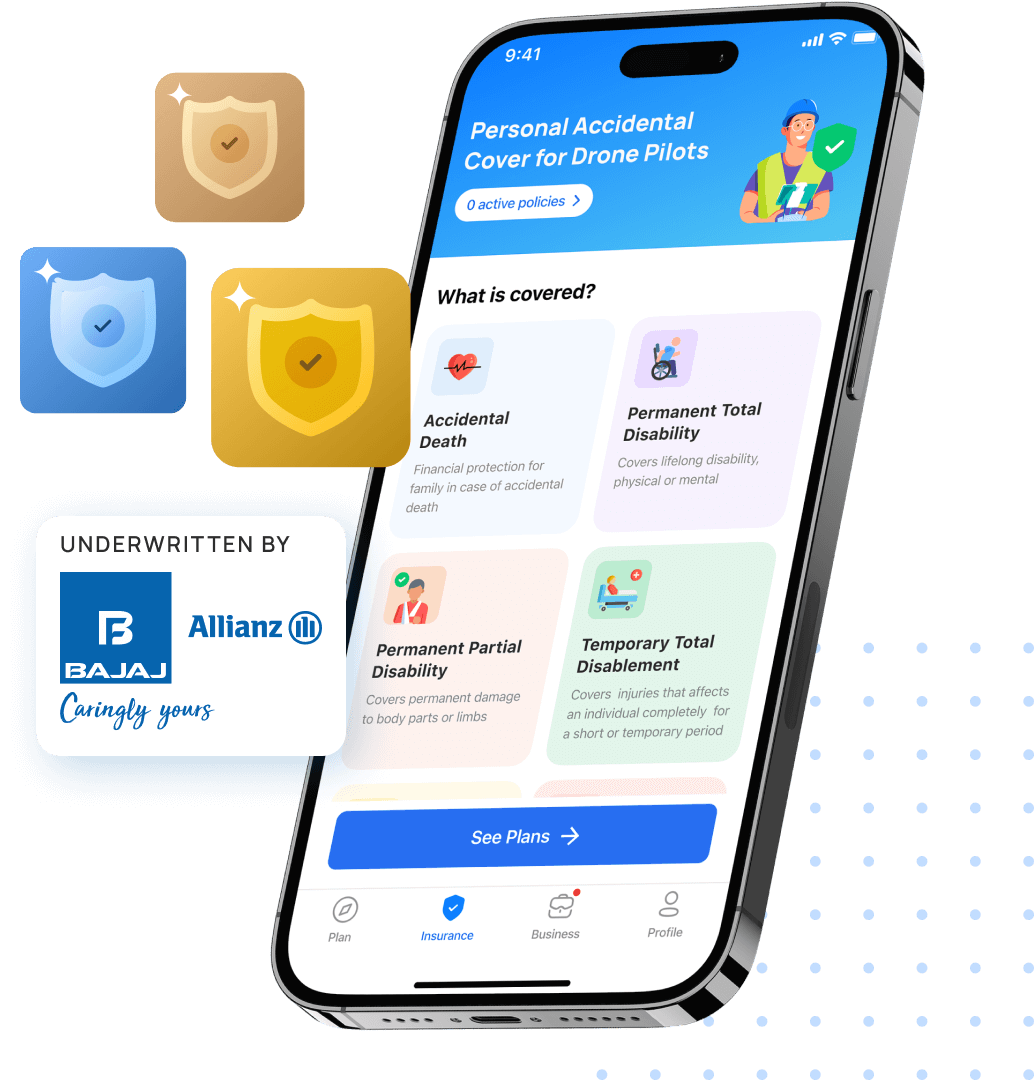

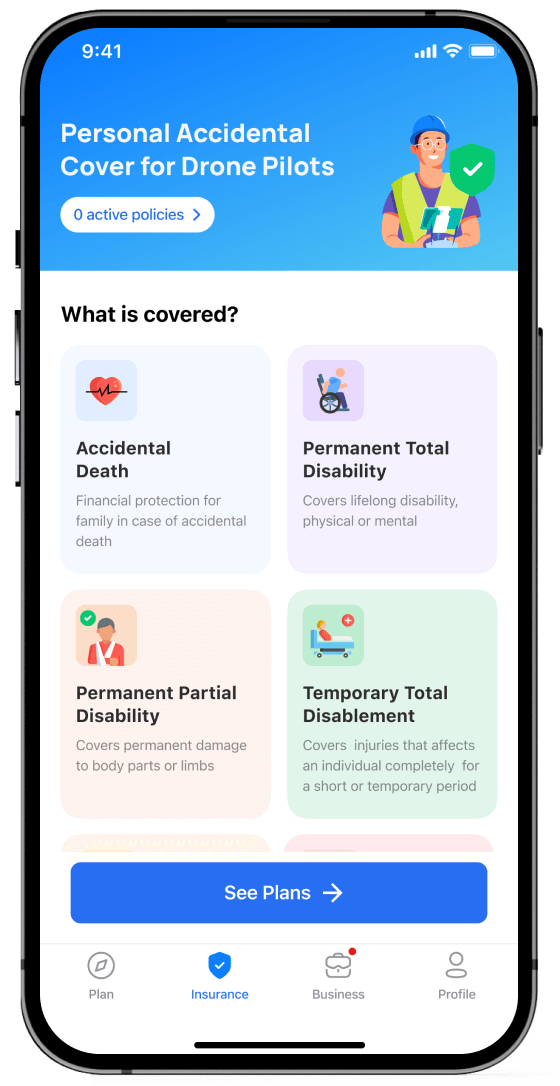

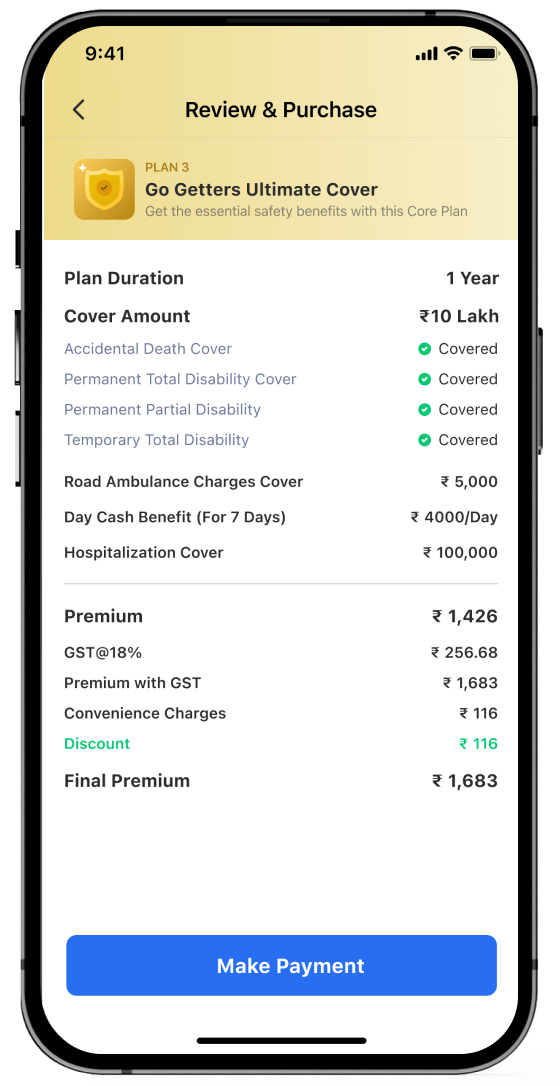

Personal Accident CoverCashless treatment at 7000+ hospitals & more

Hospicash InsuranceDaily cash allowance for hospitalization

BVLOS CoveragesCustom coverage for BVLOS flights

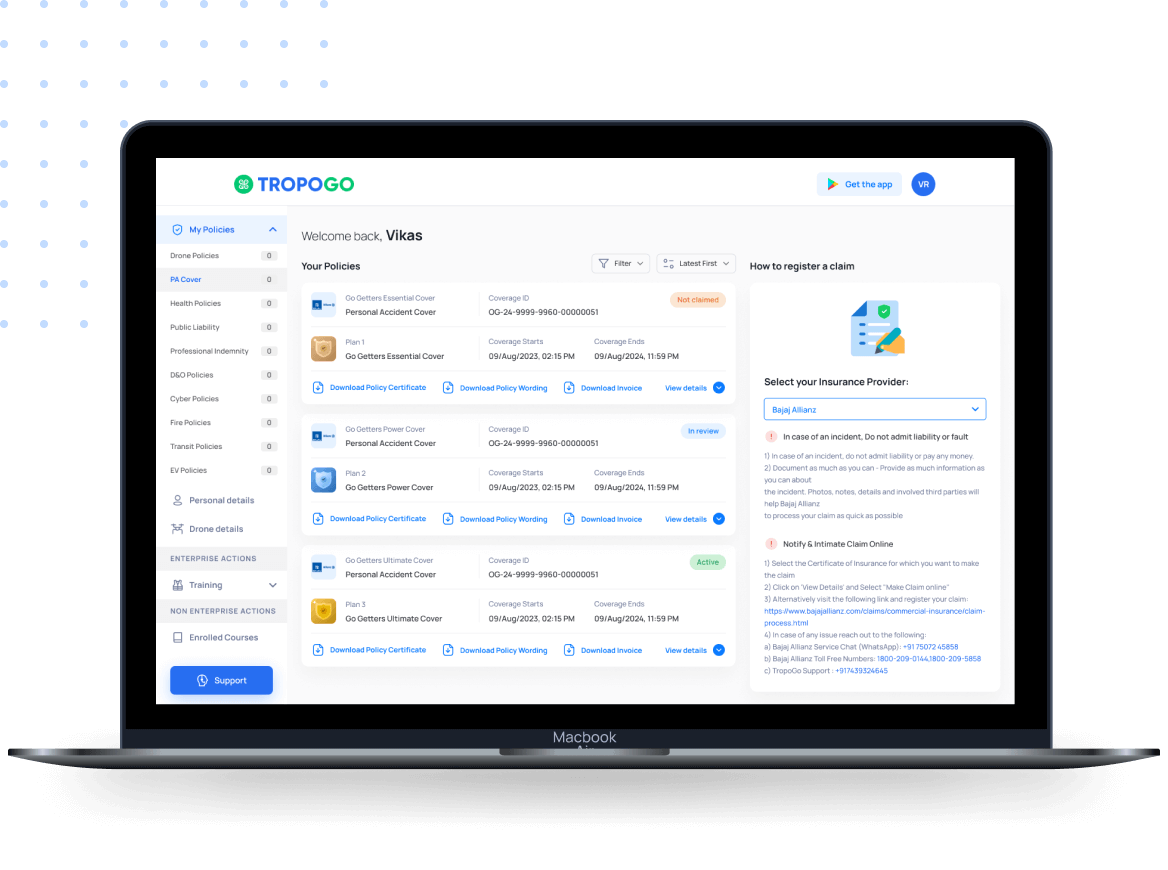

My CoveragesYour purchased drone coverages

FAQsAnswers to your insurance queries